What makes Canada a leading mining nation?

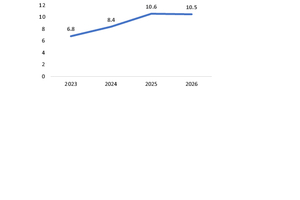

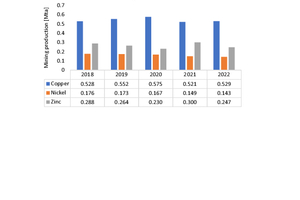

Canada‘s mining industry has 430 000 direct employees and accounts for 6.0 % of the country’s economic output. In terms of exploration expenditure, the country has ranked in one of the top places for years. This article provides current figures and impressions concerning the key resources and companies, and explains why Canada counts as a leading mining nation.

1 Canada’s economic development

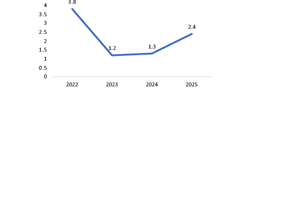

Canada has an important geostrategic role in the G7, yet does not always subordinate itself to the goals of other nations. One example is defence spending, which totalled 36.7 bill. US$ in 2023, a handsome sum, but only 1.29 % of the country’s economic output and accordingly well below the 2 % specified by the USA and the spending of other NATO partners. In economic terms, Canada is faring better than most other western nations. The recession forecast by economic experts has been avoided. Inflation has fallen from a peak of 8.1 % in June 2022 to 2.9 % in January...

![2 Value creation in Canada’s mining sector [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_d80246bf6fe75dbf9d307803a073fddf/w300_h200_x297_y421_02_Harder_Can_Wertschoepfung-0ed850745a9b25ec.jpeg)

![3 Critical resources in Canada [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_2eb47dacaae7d09d916806de6ce5ff85/w300_h200_x600_y419_03_Bild3L_CriticalMineralsMap2024EN-03-01-79e6dc2e9f74c754.jpeg)

![4 Capex in Canada [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_a9f5196fdd3779b012fe29700e45c7c4/w300_h200_x600_y538_04_Bild4L_CapEx_2023_by_subsector-a0e203b682b0bed9.jpeg)

![5 Global production of potash in 2022 [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_820738fd63e5973ea116dc019d8d441f/w300_h200_x297_y421_05_Harder_Pottasche-e0c9486114867420.jpeg)

![18 Canada‘s international mining assets [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_02f1279f841e0a053123dad5e4a1116a/w300_h200_x600_y305_18_Bild18L_Canadian_Mining_Assets_New-918fbb5567f41935.jpeg)

![20 Development of critical resources [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_93408efd42813a8e5aeed9080b9c019a/w300_h200_x297_y421_20_Harder_krit_Rohst-348e8a8cfafa2237.jpeg)

![21 Development of raw material reserves [1]](https://www.at-minerals.com/imgs/2/1/5/0/4/5/1/tok_247b10baba47a8fed3876acaa7af107e/w300_h200_x297_y421_21_Harder_Rohstoffreserven-f1f971b7eaf66b4c.jpeg)