Current hotspots in the African mining industry

Summary: In 2020, around 11.6 % of global exploration expenditure went on non-ferrous mining in the African region. Formerly leading countries, like South Africa, Zambia or Botswana, however, no longer hold the top spots. In the following report, the current hotspot countries in Africa are presented and the key developments and mining enterprises there examined. In many of these countries, small-scale mining plays a not insignificant part.

1 Introduction

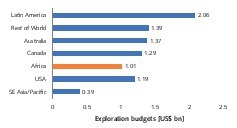

Around one third of the world’s mineral resources are deposited in Africa. For diamonds, gold, platinum group metals (PGM), cobalt, vanadium, chromium and manganese ore, the continent takes the number one spot for global reserves. Extensive new copper deposits have been discovered there, too. More than 430 mining companies are active in Africa. The most important mineral resources that these companies are digging for in Africa include diamonds, gold, copper, uranium ore, PGM, nickel, but also coal, iron ore and bauxite [1]. Africa currently holds a share of only 11.6 % of the current exploration budget. This is the finding of a study by the esteemed S&P Global Market Intelligence in its latest report [2]. For this report, the budgets of 1762 mining companies for the non-ferrous sector were studied.

The global non-ferrous exploration budgets fell by 11 % from US$ 9.8 bill. in 2019 to US$ 8.7 bill. in 2020. For 2021, however, a strong recovery of 15 to 20 % is expected, as especially the TOP 40 mining companies were still able to increase their income, profits and capitalization considerably despite the Corona pandemic. Fig. 1 shows the breakdown of the global exploration budgets by region. Latin America accounts for US$ 2.065 bill. (- 21 %) of exploration spending, followed by Australia with US$ 1.371 bill. (- 10.3 %). With US$ 1.01 bill. (- 10 %) Africa still takes fifth place behind the rest of the world (with Europe, Russia and China) and Canada, but ahead of the USA and Southeast Asia. The only region in which the exploration budgets were up in 2020 compared with 2019 is Russia. The increase there was 6 %.

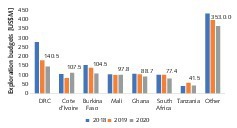

Fig. 2 shows how the exploration budgets in the key countries in Africa have changed in recent years. The ranking is still led by the Democratic Republic of Congo (DRC) with a budget of US$ 140.5 mill., although there has been a notable slump compared to 2019 and especially 2018. Thanks to massive investment, the Ivory Coast has climbed ahead of Burkina Faso, which has suffered a significant loss compared to the last two years. Ghana and Mali have largely maintained their rankings, while South Africa has dropped back further. Other key countries are Tanzania and Namibia, while upcoming countries include Madagascar, Guinea and Senegal. Angola, Zambia and Botswana have dropped in significance with regard to investments.

2 Current hotspots in Africa

2.1 DR Congo

In the Democratic Republic (DR) of Congo, 89.6 mill. people currently live on area of land roughly the same size as Western Europe. In 2018, 73 % of the population were living there under the poverty line of 1.90 US$/day. In recent years, the economy has experienced an upswing with growth rates of 5.8 % in 2018 and 4.4 % in 2019. In the pandemic year 2020, economic growth slowed to - 0.1 %. For 2021 and 2022, the International Monetary Fund (IMF) forecasts growth rates of 3.8 % and 4.9 %, respectively. Economic growth has been spurred on by the mining industry. Sales in the sector reached US$ 2.49 bill. in 2019 and US$ 2.74 bill. in 2018.

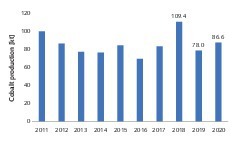

The DR Congo is rich in important mineral resources such as diamonds, gold, copper, cobalt, tin, manganese ore, lithium, and tantalum [3]. For many of these minerals, demand is booming, especially as a result of the trend towards electromobility and high-performance battery cells. So according to the firm of consultants Benchmark Mineral Intelligence, the demand for cobalt in battery cells is set to increase from 20 thousand tonnes per year (kta) in 2019 to 730 kta in 2040. Fig. 3 shows how cobalt production in the DRC has developed since 2011. The largest quantities were achieved in 2018 with 109.4 kta. With 68 % of the global cobalt production, the DRC has almost a monopoly for this resource. The other key producers are Russia (4.5 %), Australia (4.1 %), the Philippines (3.3 %) Cuba (2.6 %), Canada (2.3 %) and others (15.2 %).

Die DRC Ministry of Mines gives a figure of 86.6 kt for the quantities produced in 2020. Glencore, the world’s largest producer of cobalt only reached an output of 23.9 kta in 2020 following 42.2 kta in 2019 from the copper mines in the DRC, where cobalt hydroxide is extracted as a by-product. Glencore had decided to mothball the Mutanda mine. The shortfall was partly offset by the start-up of the Katanga mine (Fig. 4). Other important cobalt producers in the DRC are China Molybdenum (CMOC) and the Minerals and Metals Group (MMG), which is part of China Minmetals. In 2020, CMOC produced 15.4 kt cobalt, down on 16.1 kt in 2019, while MMG reached 4.5 kt. In addition, the Chinese Wanbao Mining and Zijin Mining, also based in China, as well as the state-owned company Gécamines are active there.

In copper mining, with an output of 1.71 million tonnes per year (Mta), the DR Congo now ranks third worldwide behind Chile (5.7 Mta) and Peru (2.2 Mta). Since 2016, copper output has been increased by around 67 %. Moreover, Ivanhoe Mines started up operation at the Kamoa-Kakula copper mine (Fig. 5) in May 2021. In the first phase of development, 0.2 Mta copper will be produced, in the second phase, the mine is to produce 0.4 Mta copper. Planned is a peak production of over 0.8 Mta. The project is a joint venture of Ivanhoe Mines, the Zijin Mining Group, River Global and the DR Congo. With 38 Mt copper plus 5.57 Mta expected copper reserve, Kamoa-Kakula has the fourth largest copper reserves after the Olympic Dam mine in Australia and the Escondida and Collahuasi mines in Chile. The copper content in the ore averages a very high 4.47 % for 10.5 Mt of the reserves.

Artisan small-scale mining still accounts for a sizeable share of mining operations in the DR Congo. Up to 1 million people work in this sector, in sometimes very poor conditions. In recent years, the government has introduced reforms in an attempt to improve the structures and conditions in small-scale mining. Around 25 to 30 % of the cobalt output comes from artisanal small-scale mining. Of the mineral coltan (tantalum), of which in 2020 around 1710 t were extracted, the entire production comes from small-scale mining. In diamond mining, around 8.5 million carat or 66 % of the mined output were extracted in small-scale mining in 2020, industrial mining accounted for 4.4 million carats or 34 %. In gold mining, on the other hand, the output extracted in small-scale mining declined from 442 kg in 2016 to 76 kg in 2020, while the total output reached 30.9 t – following 24.7 t in 2019 and 36.2 t in 2018.

2.2 The Ivory Coast

In the Ivory Coast, 26.2 million people live in an area around the same size as Norway. Since 2012, the country has enjoyed robust and steady economic growth with average growth rates of almost 8 %. Further efforts have been made to fight poverty in the country, which now stands at 39.4 %, down on 45.3 % in 2015. As a result of the Corona pandemic and unrest during the presidential elections, economic growth cooled down in 2020 to + 2.3 %. For 2021 and 2022, the IMF forecasts an increase in growth to 6.0 % and 6.5 %, respectively. The Ivorian mining sector generated sales of almost US$ 1.3 bill. in 2019. The government’s goal is to make mining, with a share of 4 % in the GDP, a second mainstay in economic and social development.

The key mine products of the Ivory Coast are gold, manganese ore and diamonds. In 2019, a record quantity of 32.48 t gold was extracted, up on 24.06 t in 2018 and 13.2 t in 2012. In the country, seven gold mines are in operation, three more will be added by 2021. The Tongon Mine (Fig. 6) owned by Barrick Gold is currently the biggest gold supplier in the country with a planned output of 285 kilo ounces (kOz) and reached 255 kOZ in the year 2020. It is followed in the ranking by Endeavour Mining with the Ity-CIL-Mine and an output of 212.8 kOz in 2020 and the Agbaou-Mine with 105 kOz in the year 2020. Perseus Mining operates the Sissingué Mine and since 2020 the Yaouré Mine, too. Roxgold is represented with the Séguéla Mine. The other companies that mine gold are SMI (Société des Mines d’Ity), Centamin and Bonikro Gold. Expansion projects are currently being pushed ahead by Endeavour Mining (Fetekro) and the Montage Gold Corp. (Bobosso, Koné and Korokaha).

The immediate neighbouring countries Gabon and Ghana are some of the most important manganese ore producers. In recent years, the Ivory Coast has been able to gain ground here, too. The manganese ores there have a manganese content up to 38 %. After 0.79 Mta in 2018, 1.18 Mta was extracted in 2019, which corresponds to an increase of 49 %. Shiloh Manganese is the number one in the country with an output of around 0.5 Mta in the business year 2019/2020. In second place in the ranking follows the China National Geological & Mining Corporation. Compagnie Minière du Littoral (CML) is another producer. Up to now, the manganese ore has only been extracted in surface mines. Relatively large reserves can be found in the sea off the Ivorian coast.

2.3 Burkina Faso

Burkina Faso has a population of 20.9 million. Up until the Corona pandemic, the country was one of the countries enjoying the biggest economic growth in Africa. This totalled 6.8 % in 2018 and 5.7 % in 2019. In 2020, growth of the economy cooled to + 0.8 %. In 2017, the mining industry generated 71 % of the country’s exports, 16 % of tax revenues and 8.5 % of the gross social product. In 2020, only a total of 14 mines were active in Burkina Faso, including 13 gold mines and one zinc mine. The number of the exploration licences, however, has increased considerably in recent years, from 40 in 2014 to more than 700 in 2020.

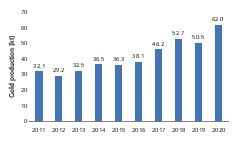

Fig. 7 shows how mined gold output has developed in the country in recent years. From the year 2010, the quantities increase from 22.5 t gold to 50.5 t in 2019 and have more than doubled. Currently, the output with inclusion of the small-scale operations totals 62 t, so that the country takes fifth place in Africa, behind Ghana, South Africa, Sudan and Mali. The most important producers in 2020 are Endeavour Mining (Fig. 8), which with the four mining operations at Karma, Houndé, Mana and Boungou reaches a total output of 748 kOz gold, followed by Iamgold with the Essakane Goldmine with 364 kOz and Nordgold with the mines Bissa and Bouly with 227 kOz. Endeavour Mining had only recently taken over Semafo and has therefore advanced to become the largest gold producer in West Africa. In Burkina Faso, the company is pursuing three development projects Golden Hill, Bantou and Nabanga.

2.4 Mali

In Mali, 20.3 million people live on an area of 1.22 mill. km2, which corresponds to the combined size of France, Spain and Portugal. The country lies in the Sahel Zone – a region known to be a safe haven for Islamist fighters and organized immigration crime. Eight years ago, the UN Security Council set up a peacekeeping force there to prevent the country sliding into chaos.

But the security situation remains uncertain and alarming. Surprisingly, industry and especially the mining sector have not been severely affected. After economic growth rates of 4.7 and 4.8 % in the years 2018 and 2019, 2020 was a year with negative growth of - 2.0 %, but for 2021 and 2020, growth rates like those before the pandemic year are forecast.

Mali lives practically from gold mining. Otherwise, only a little phosphate is mined. In 2019, 71.0 t gold was mined, up on 61.2 t in 2018, so that Mali takes fourth place in the ranking in Africa. It is estimated that almost 6 t are extracted by small-scale operations. The export of gold makes up 70 % of Mali’s exports. The industrial gold producers are currently operating 13 mines in Mali. The largest producers at present include Barrick Gold, B2Gold and Resolute Mining. In 2020, Barrick Gold produced a total of 717 kOz gold at the three mines Loulo-Gounkoto und Morila in Mali. B2Gold reaches 622 kOz with the Fekola mine. At the Syama gold mine (Fig. 9), Resolute Mining extracted 3.4 Mta sulphide and oxide ore and output a total of 222 kOz gold. In 2020 Iamgold, AngloGold Ashanti and Barrick Gold sold their stakes in the exhausted Sadiola and Morila gold mines to the Allied Gold Corp. Gold is now being recovered from the tailings there.

2.5 Ghana

In Ghana, 31.1 million people live in an area of land roughly the same size as Rumania. Thanks to oil reserves and mineral resources, the country is now one of the middle-income countries in Africa. The economy can report impressive growth rates of 8.5 % in 2017, 6.3 % in 2018 and 6.5 % in 2019. In 2020, growth slumped to + 0.9 %, whereas for 2021 and 2022 the IMF expects growth rates of 4.6 % and 6.1 % respectively. Accounting for over 90 % of income, gold mining has been the mainstay of the Ghanian mining sector. The exploitation of other mineral resources like manganese and bauxite is set to increase considerably in the mid-term.

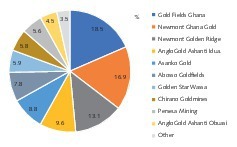

With a mined output of 114 t in 2020, gold mining in Ghana leads the African countries. However, the output of 129.2 t in 2019 has slumped considerably. Fig. 10 shows the shares of the most important gold producers for 2020 according to data from the Ghana Chamber of Mines. According to these data, Gold Fields leads the field with 18.5 % of the mined output, followed by Newmont Ghana Gold with the Ahafo-Mine, and Newmont Golden Ridge with the Akyem-Mine. With the two mines, Newmont produced 214 kOz less than in 2019, which was primarily down to ore with lower gold content being extracted. Galiano Gold, which with its 50/50 joint venture with Gold Fields at the Asanko Gold Mine (Fig. 11) ranks fifth in the national ranking, was on the other hand able to maintain its production from 2019 with an extracted output of 250 kOz. With the Asumura project in the Sefwi gold belt, the company has another interesting project in Ghana.

The Ghana Manganese Company (GMC), which has a monopoly on the production and export of Ghanaian manganese (Fig. 12), drastically increased its production output from 1.29 Mta in 2015 to 5.38 Mta in 2019 and sales totalling US$ 412 mill. GMC has been granted a mining concession for manganese over an area of 170 km² in the Nsuta region in the west of the country, from which less than 3 % has been extracted so far. For bauxite, the Ghana Bauxite Company in Awaso has had a monopoly up to now. The company was able to slightly increase the bauxite output from 2018 to 1.16 Mta in 2019. Since 2017, when 1.48 Mta were reached, output has decreased significantly. In 2018, the governments of Ghana and China decided that China would finance rail, road and bridge networks to the value of US$ 2 bill. and would receive access to 5 % of Ghana’s bauxite reserves in return.

2.6 South Africa

South Africa has 59.6 mill. inhabitants. The land area is slightly smaller than that of Mali. Economic growth in the years 2018 and 2019 was only slightly above the zero mark. The Corona pandemic has hit the country relatively hard so that the economy in 2020 shrank by - 7.0 %. For 2021 and 2022, the IMF forecasts a slight recovery to 3.1 % and 2.0 %. In 2020, the mining industry accounted for 8.2 % of the gross domestic product, but compared to the previous year the mining GDP fell by 13.2 %. The number of people employed in the mining industry decreased further to around 451.4 thousand. Two thirds of the mining operations are operating on a global scale in the upper half of the cost curve. There have been almost no greenfield explorations in recent years.

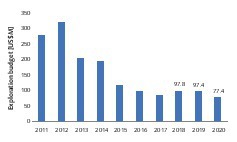

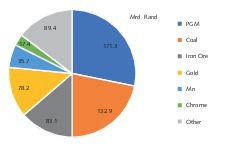

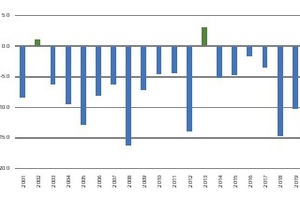

Fig. 13 shows how the exploration budgets in South Africa have changed over the last ten years. In 2020, the value was still at US$ 77.4 mill., down from US$ 97.4 mill. in 2019 and around US$ 325 mill. in 2012 and US$ 405 mill. in 2007. Of the expenditure in 2020, US$ 25.2 mill. went on the platinum group metals (PGM), US$ 18.2 mill. on gold extraction, US$ 10.2 mill. on base metals, US$ 6.3 mill. on diamonds and US$ 17.4 mill. on other minerals. Fig. 14 shows the shares of the country’s key mining products in the industry revenues. PGM reach with 171.3 bill. rand (around US$ 11.9 bill.) or 28.2 % the first place in the ranking, followed by coal and iron ore. Gold is in fourth place and, with an output of 90.8 t in 2020, fell by - 13,7 % (Fig. 15), while positive growth only being registered in the years 2012 and 2013.

PGM are the most important mining product in South Africa, but the industry is facing huge problems [1]. In 2020, production levels fell by 18.1 % to 219.7 t. The number of employees fell further to 163.5 thousand. The leading companies in the sector are Sibanye Stillwater, Anglo American, Impala Platinum (Implats) and Northam Platinum. In the business year 2020, Sibanye Stillwater extracted a total of 2202 kOz PGM (4E/2E) at the five mines Marikana, Kroondal (Fig. 16), Mimosa, Platinum Mile and Rustenberg. 95 % came from underground mining and just 5 % from surface mining. Anglo American has extracted 1828 kOz from the Mogalakwena, Amandelbult and Mototolo mines. Implats reaches 1254 kOz and Northam 523 kOz. The South African mining industry is aware that the sector only has one chance, that is if the exploration budgets are increased considerably. Otherwise, the migration was set to continue.

2.7 Tanzania

Tanzania has a population of 59.7 million and an area of land larger than that of Germany and Spain together. The country is regarded as politically stable, however, freedom of the press and freedom of assembly has been increasingly restricted. Over the last ten years, the Tanzanian economy has grown by an average of over 6 % annually. In the years 2018 and 2019, economic growth amounted to 7 % in each year and in 2020 still + 1.0 %. For 2021 and 2022, the IMF is expecting a cooling to 2.7 % and 4.6 % overall. The most important mining products are gold, diamonds and coal. Gold is mined mainly in the Greenstone belt along Lake Victoria. Diamonds are extracted in the Williamson mine and coal comes from the Ngaka and Rukwa coal mines.

Gold production has risen in the last 25 years from 5 to around 50 t per year and, with almost 90 %, is now the most important source of revenue in the mining sector. In 2020, 45.9 t were extracted, including around 11.5 % from small-scale mining. The most important producers are AngloGold Ashanti with the Geita Gold Mine and a production of 623 kOz in 2020, followed by Barrick Gold with the three mines Bulyanhulu (Fig. 17), Buzwagi and North Mara and 462 kOz as well as Shanta Gold with 83 kOz. TanGold is developing the Buckreef Gold project, where gold reserves of 2.1 MOz have been detected. Petra Diamonds owns the Williamson Mine, where in 2020 maximum quantities of 399 k carat were extracted. In coal extraction, the extraction rates of Tancoal and Edenville Energy fell by 53 % to a total of 540 000 t in 2019.

3 Outlook

According to a forecast by the IMF, the price index for base metals in 2021 will increase by around 32.0 % and fall by 4.5 % in 2022. Uncertainty factors in the forecast are the speed of the global economic recovery and potential production and trade disruptions on account of the pandemic. Precious metal prices will probably increase by 6 % in 2021 and 0.4 % in 2022, as a continued expansive monetary policy is expected. The prices for copper and iron ore, which are used especially in the construction and manufacturing industries have been boosted by the current situation. The strong demand for electric vehicles and batteries has seen the prices for lithium, cobalt and nickel rise.

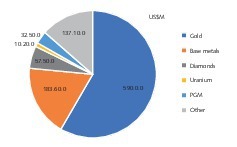

In the exploration budgets in Africa, part of this trend can already be identified. As the data from S&P Global Market Intelligence in Fig. 18 show for 2020, 58.4 % of the money goes into the exploration of gold mines, 18,2 % in base metals like copper, lead, tin and nickel, 3.2 % in platinum group metals, 5.7 % in diamond mining, 1 % in uranium and 13.6 % in other metals and minerals. The leading countries for base metals remain the DR Congo with US$ 107.8 mill exploration budget ahead of Zambia with US$ 26.8 mill., South Africa with US$ 10.2 mill. and Botswana with US$ 9.2 mill. Interesting is that in Zambia and Botswana grassroot projects are playing the most important part which in the DR Congo and South Africa so-called late-stage and mine-site projects predominate.

Literature

[1] Harder, J.: Hotspots – Development in mining in Africa. AT MINERAL PROCESSING, 04/2017, pp. 58-72

[2] S&P Global Inc.: World Exploration Trends 2021, PDAC Special Edition, S&P Global Market Intelligence, March 2021, London/UK

[3] Harder, J.: Conflict-free minerals – A look behind the scenes. AT MINERAL PROCESSING, 04/2016, pp. 52-65

Author:

Dr.-Ing. Joachim Harder, OneStone Consulting Ltd., Varna/Bulgaria

Joachim Harder (1952) studied process engineering at Braunschweig University of Technology and earned his Ph.D. there. After more than 10 years working in industry in various management posts, in 1997 he established the consulting company OneStone Consulting. Dr. Harder is an acknowledged expert in international marketing, specializing in market analysis for business segment strategies. He is the author of diverse publications and a popular conference speaker.