Recovery

Canada’s mining industry experiencing an upswingSummary

Owing to Canada’s rich mineral resources, the mining industry is an important economic factor for the country. The severe slump in mining production experienced during the crisis year 2009 was already practically recouped in 2010, and current information indicates that the mining industry intends to push expansion by investing 130 billion Canadian Dollars by 2015. This report provides details about the most important ores, the companies involved in ore mining and the planned future projects.

1 Introduction

In comparison with the Euro countries, Canada’s economy suffered little damage during the recent global economic crisis. The average real economic growth was 2.1 % between 2000 and 2009; in 2009 the country had a negative growth of 2.5 %; in 2010 the economy was back in positive growth mode with +3.1 % and for 2011 and 2012 everything points to an ongoing positive trend. The mining industry, however, went through a distinctly worse phase. This was due to the steep fall in raw materials prices and the drastic decline in demand for raw materials. As a consequence, a number of mines were temporarily closed in 2009 and many expansion projects were put on ice. All sectors of mining were affected, i.e. metals, nonmetals and coal, but the metals and nonmetals sectors were significantly harder hit than the coal industry.

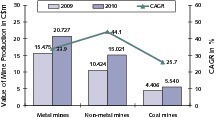

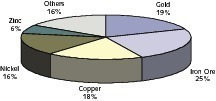

Fig. 1 shows the revenue achieved by the individual sectors of mining in Canada in 2009 and 2010. The strong upturn on all three sectors is obvious. The nonmetals sector achieved the biggest increase with +44.1 %, but the +33.9 % of the metals sector and the +25.7 % of the coal sector demonstrate the drastic overall improvement. According to current information, the mining industry intends to promote expansion by investing 130 billion Canadian Dollars (C$) over the next five years. A significant portion of this is earmarked for the mining of metals. Fig. 2 shows the contributions to the overall revenue made by the most important metals iron ore, gold, copper, nickel, zinc and others in 2010. Fig. 3 illustrates the enormous direct contribution to the Canadian GNP of the various mining sectors in the years 2005-2009, and the severity of the decline in the crisis year 2009 [1].

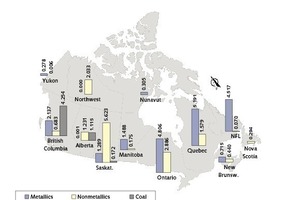

The map in Fig. 4 indicates the provinces with the most important mining locations and the main mineral resources exploited there. This illustrates the fact that mineral resources are distributed over the whole of Canada. However, Fig. 5 shows that a few provinces, such as Ontario, British Columbia, Sasketchewan, Quebec and Newfoundland/Labrador are particularly blessed with rich resources. The main locations for metals are Ontario, Quebec and Newfoundland/Labrador, while nonmetals are especially to be found in Sasketchewan, Ontario and the Northwest Territories and coal mining is concentrated in British Colombia and Alberta. The provinces contributing relatively little to the mining industry are Yukon, Nova Scotia, New Brunswick and the territory of Nunavut. The potash industry, in which Canada is the world leader, is outside the scope of this report. Relevant information is provided in another market report [2].

2 The coal industry

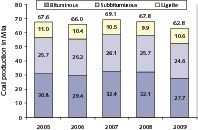

The country’s coal reserves are estimated to be 8.7 billion tonnes, of which 6.6 bn. can actually be mined [3]. If the present mining output (Fig. 6) of just under 70 million tonnes per year (Mta) is kept up, reserves are assured for 100 years. 44 % of the mining output is made up by hard coal, followed by steam coal with 39 % and lignite with 17 %. Canada’s coal mines play a leading role in the country’s power supply network, which includes 21 coal power stations. The province of Alberta is the biggest consumer of coal, accounting for 47 % of Canada’s total demand and possessing 53 % of the country’s coal-fired power stations. In 2010, Canada ranked 7th in the TOP coal exporting countries with an export volume of 31 Mta, after Australia (298 Mta), Indonesia (162 Mta), Russia (109 Mta), the USA (74 Mta), South Africa (70 Mta) and Columbia (68 Mta). The export quantity of 32 Mta included 27 Mta of coking coal and 4 Mta of steam coal.

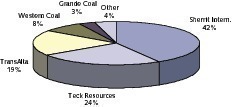

In 2009 there were 22 coal mines in Canada [3], most of which are located in Western Canada. 10 of these are situated in British Columbia alone, nine being in operation in 2009 while one (Willow Creek Mine) was temporarily shut down. Fig. 7 presents an overview of the available capacities of the leading companies. The market leader is Sherritt International (Sherritt) with a capacity of 34.0 Mta at eight mines, followed by Teck Resources (Teck) with a capacity of 19.7 Mta at five mines and the energy providerTransAlta with 15.8 Mta at two mines (Fig. 8). After these come Western Coal (WCC) (6.5 Mta, 3 mines), Grande Coal (GCC) (2.5 Mta, 1 mine) and 2 further companies (3.5 Mta, 2 mines). The total capacity is 82 Mta. Sherritt is the main supplier of steam coal and lignite for the domestic power station sector. Coking coal and PCI coal (PCI = Pulverized Coal Injection) for exportation are produced by Teck, WCC and GCC.

There are a number of plans for expanding capacities. Teck intends to raise its capacity to more than 30 Mta by 2014 by boosting the output of all its 6 existing mines. In British Columbia, Teck is planning to bring another mine with a capacity of 3.0 Mta into service in 2013. Sherritt is currently examining its options for capacity expansion. TransAlta is planning to increase the output of its Highvale Mine by 1.8 Mta to supply the new Keephills3 power station. In British Columbia, the Compliance Energy Corp (CEC) has entered into a joint venture to develop the 1.5 Mta Raven Project. In 2010, Xtrata began developing the 2.7 Mta Donkin underground mine in Nova Scotia to produce coking coal for export. GCC is going to increase its mining capacity from 2.5 Mta to 3.5 Mta by 2013.

3 The iron ore industry

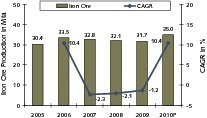

The Canadian iron ore mining output fell only slightly by 1.2 % from 2008 to 2009 (Fig. 9), because China’s high requirements prevented global demand from declining significantly. In 2010 Canada again experienced a strong upsurge of 10.4 %, bringing output to 35.0 Mta. On a worldwide scale, this production quantity of 35 Mta puts Canada in ninth place. In comparison with China (900 Mta), Australia (420 Mta) and Brazil (370 Mta) the country’s mining output rate is small. Almost 30 Mta of the produced quantity is exported in the form of pellets or iron ore concentrate, mainly to Europe and the Asian countries. Just under 10 Mta are imported for the domestic steel industry.

As a rule, Canadian iron ore has an iron content of between 30 and 45 %. This is relatively low compared to iron ore deposits in Brazil, which have a content of 68 %. For this reason, various concentration stages are employed downstream of the crushing and grinding systems. The most often used processes are gravitation and magnetic systems such as helixes, low and high-intensity magnetic separators and electrostatic separators, which deliver concentrations of around 65 %. Practically the entire iron ore production is currently in the hands of only four companies and takes place in the so-called Labrador Belt, a 1600 km long and up to 160 km wide belt extending from the south-southeast of the country up to Quebec and Labrador.

One of the market leaders is the Iron Ore Company of Canada (IOC), which is majority-owned (58.7 %) by Rio Tinto. IOC’s mining operation, working ore with an average iron content of 39 %, is located in the vicinity of Labrador City. Like all other producers, IOC uses the truck/shovel method (Fig. 10), for mining the ore. IOC’s concentrator has a capacity of 17 Mta, of which 13 Mta are pelletized and 4 Mta are concentrated by other methods. Another leading company is ArcelorMittal Mines Canada (formerly QMC), who have a capacity of 15 Mta of iron ore concentrate and 9 Mta of pellets. The remaining producers are Cliffs Natural Resources (approx. 6.0 Mta capacity) and Consolidated Thompson Iron Ore Mines (7.0 Mta capacity). Iron ore is also obtained as a by-product of magnetite mining.

One of the biggest development plans is that of New Millennium/Tata Steel, who intend to implement two 15 Mta projects - LabMag and KéMag. An even larger project is being pursued by Labrador Iron Mines Ltd. This is to be implemented in three phases, the first of which commenced in 2011 with an 8.1 Mta mine working the James Deposit. Arcelor Mittal is planning a C$ 2.1 billion investment to boost the output of the Mt. Wright Mine in Quebec from the present 14 Mta to 24 Mta. The expansion work is due for completion in 2014. Baffinland Iron Mines Corporation is planning a major project (the Mary River Project) on North Baffin Island in the Nunavut territory of Canada’s Arctic region (Fig. 11). Arcelor Mittal has a 70 % stake in this company. Other projects are being pursued by Adriana Resources, Roche Bay plc. and Champion Minerals Inc.

4 The base metal industry

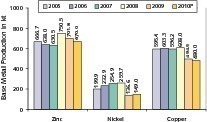

The most important base metals that are mined as ores are copper, nickel and zinc. However, significant quantities of uranium, aluminium, lead, cobalt, molybdenum, niobium and platinum-group metals (PGM) are also mined. Fig. 12 shows the mining output rates for the three most important base metals in the period 2005-2010 /4/. The last output statistics for zinc showed an annual output of 670 000 tonnes. In 2009 the zinc output rate only declined by 6.5 % compared to 2008, which was a peak year. In the case of nickel, output fell by 47.4 % in 2009. The latest figure of 149 000 t indicates a slow recovery of the market. Copper mining output only dropped by 18 % in 2009. However, 2010 did not bring any real recovery and output decreased by a further 3.7 % to 480 000 t.

Canada is the ninth biggest copper producer in the world, with an output of 480 kt. The leading producers are Chile (5520 kt), Peru (1285 kt), China (1150 kt), the USA (1120 kt) and Australia (900 kt). The remaining Canadian copper reserves are estimated to be 7.45 Mt. In Canada, copper ore is generally mined in combination with other metals, such as nickel, zinc, lead and gold. Most deposits consist of massive sulphidic ores (e.g. Sudbury Area) or porphyry ores (e.g. Highlands Valley). Approximately 45 % of copper mining output comes from the province of British Columbia (BC), while another 25 % come from Ontario. The rest is mainly distributed among the provinces of Manitoba, Newfoundland, Quebec, Yukon and New Brunswick. Approximately 63 % of the refined copper is exported and 37 % is consumed by the domestic market.

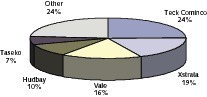

Fig. 13 shows the market shares of the most important Canadian copper producers. The market leader is Teck Resources with a market share of 24 % based on the output of only two mines (Highland Valley, Duck Pond). Teck owns other mines in Peru and Chile and produced a total of 308 000 t of copper in 2010, generating 28 % of company turnover and 37 % of its operating profit. Second and third places go to the major international players Xstrata and Vale with 19 % and 16 % market share respectively. Xstrata operates no fewer than six mines in Canada. Vale owns two mines (one of which is Sudbury), where copper is mined in combination with nickel. The remaining important players on the market are Agnico-Eagle Mines (AEM) (Fig. 14), which - like other producers - obtains copper as a by-product of gold mining, Hudbay Minerals, Capstone Mining (Fig. 15), Taseko Mines, Imperial Metals and Northgate Explorations.

Around 3.6 Mt of nickel are still available in Canadian ore deposits. On a global scale, Canada’s mining output of 149 000 t puts it in fourth place after Russia (265 kt), Indonesia (232 kt) and the Philippines (156 kt). Nickel is mined in four provinces - Ontario, Newfoundland (NFL), Manitoba and Quebec, with Ontario accounting for 34 %, NFL for 27 %, Manitoba for 20 % and Quebec for just under 19 %. Processing into nickel products takes place in three refineries and one smelting plant. Only around 5 % of the mine production and refined metal remains in Canada, while 95 % is exported. About 70 countries purchase the range of different nickel products from Canada. The biggest production capacities and outputs are accounted for by Vale with 210 kt or 78 % market share and Xstrata with 50 kt and 18.5 % market share. Taken together, the remaining producers FNX Mining, Liberty Mines and Crowflight Minerals only achieve a total of 10 kt or 3.5 % market share.

In the case of zinc, Canada’s mining output of 670 kt puts it in sixth place worldwide, after China (3500 kt), Peru (1520 kt), Australia (1450 kt), India (750 kt) and the USA (720 kt). The available reserves in Canadian deposits are estimated to be 5.01 Mt, i.e. if mining continues at the present rate, production is assured for only the next 7.5 years. Around 20 % of the prepared ore is consumed by the domestic market while 80 % is exported. Zinc ore is mined in six provinces. Approx. 34 % is mined in the province of Quebec, 31 % in New Brunswick, 14 % in Ontario, 13% in Manitoba, 5.5 % in British Columbia and 3 % in Newfoundland. In 2010 there were 8 zinc mines in the six provinces. Three mines had shut down permanently in 2009, one of them having gone bankrupt. In 2011 another mine will have to be closed down because the zink deposit it is working has been exhausted.

Xstrata is the market leader thanks to its Brunswick and Perseverance mines and their zinc concentrate production rates of 214 kt and 139 kt respectively. Xstrata closed down its Kidd Creek mine after the last 50 kt had been produced in 2010. Hudbay Minerals takes second place in the ranking with its 777, Trout Lake and Chisel North mines, before third-placed Agnico-Eagle Mines (AEM) with its La Ronde Mine (Fig. 16) and fourth-placed Breakwater Resources with its Myra Falls and Langlois mines. The other producers are CEZ/Noranda, NVI Mining and ScoZinc. Xstrata operates a zinc smeltery in Lachine, Quebec. Hudbay Minerals operates the Flin-Flon mine complex including a smeltery, although company information states that this was shut down in July 2010. There is also a lead and zinc smeltery operated by Teck Resources in Trail, British Columbia.

After the drastic slump in 2009, project activity for new mines and expansion of existing mines is again showing a marked upturn. In 2011, the Copper Mountain Project of Copper Mountain Mining Corp. came online. Canadian Zinc is intending to reactivate its Prairie Creek Mine (Fig. 17) as soon as possible to work a zinc/lead/silver deposit for a planned operating lifetime of about 13 years. Terrane Metals, in which Goldcorp has a substantial stake, has commenced its Mount Milligan copper/gold project in British Columbia. Paragon Minerals is planning a copper/zinc project called South Tally Pond in Newfoundland. Overland Resources is currently energetically developing its Yukon Base Metal Project as well as the Andrew Zinc Project in Canada. Victoria Nickel is implementing the Minage Nickel Project. In addition to the Junior Miners, practically all the large mining companies (such as Xstrata with its Bracemac-McLeod copper-zinc project), are planning to increase their production rates by extending their mining operations.

5 The gold industry

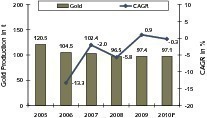

Aside from iron ore, the Canadian mining industry makes its biggest turnover with gold mining. However, Canada’s gold mining output of 97.1 t only puts it in ninth place in the world rankings after China (345 t), Australia (255 t), the USA (230 t), Russia and South Africa (both 190 t), Indonesia (120 t), and Ghana (100 t). The estimated amount of gold still in the deposits is around 900 t. Fig. 18 shows the mining production rates of recent years. This shows the practically constant decline in mining output, which is mainly due to exhausted mines being closed down without replacements being developed. Significant quantities of gold ore are mined in seven provinces. As much as 52 % come from Ontario, 26 % from Quebec and the rest from the provinces of Manitoba, Saskatchewan, British Columbia, Yukon and the territory of Nunavut.

Five Canadian companies are in the gold mining global TOP 10. These are Barrick Gold as the No. 1, Goldcorp as No. 2, Kinross Gold as No. 5 as well as Yamana Gold and Agnico-Eagle Mines (AEM) as Nos. 9 and 10. In Canada, Barrick Gold only operates the Hemlo Mine. Goldcorp is represented in Canada with three mines (Red Lake, Porcupine and Eleonore). Kinross and Yamana Gold, on the other hand, have no mines in Canada. AEM operates the Meadowbank (Fig. 19), Goldex, La Ronde and Lapa mines in Canada. The Canadian Minerals Yearbook [4], lists a total of 32 gold mines. The other most important mine operators are Xtrata, Teck Resources, Inmet Mining, Century Mining (Fig. 20), IamGold, San Gold and Apollo Gold.

One of the biggest new projects is the Meliadine Gold Project of AEM. This project is located in the permafrost region close to the west coast of Hudson Bay in the territory of Nunavut and is aimed at mining 2.6 million ounces of gold. Century Mining plans to bring its Lamaque Project in Val-d’Or, Quebec on line before the end of this year. IamGold is aiming to put its Westwood Project into operation by 2013, mining around 190 000 ounces (oz) of gold per year. Nova Gold Resources is in partnership with Teck to put the gigantic Galore Creek copper-gold project into operation. New Gold Inc. plans to complete the New Afton mining project by 2013, producing 85 koz of gold, 214 koz of silver and 34 kt of copper over a 12-year period.

6 Prospects

Chinese companies are making advances in Canada. The Wuhan Iron & Steel Group, for instance, has invested US$ 240 m for a 25 % stake in Consolidated Thompson Iron Mines’ Bloom Lake iron ore project in Quebec. The Jinduicheng Molybdenum Group has taken over the Wolverine zinc-silver project from Yukon Zinc. Also, the Jilin Jien Nickel Industry Co. has taken over 75 % of Canadian Royalties and its nickel-copper-PGM project in the Nunavut region. These moves provide China with further access to resources and will help to satisfy the country’s appetite for raw materials. In doing so, China will also profit from the infrastructure in Canada. The mining industry is, for example, responsible for 55 % of railroad freight and 70 % of harbour transshipments (Fig. 21).

The planned investment of 130 billion Canadian Dollars in the mining industry over the next five years will also have a stimulating effect. However, decreasing metal contents and the associated rise in the cost of mining, combined with poorer cost-effectiveness, have prompted Canadian mining companies to invest strongly abroad. Canadian firms already operate about 350 mines in foreign countries such as Peru, Chile, Australia, Indonesia, Papua-New Guinea and Tanzania.

![3 Beitrag der Minenindustrie für das GDP [1] ● Contribution of the mining industry to the GNP [1]](https://www.at-minerals.com/imgs/tok_e984732e402fd694aa6d90614a734538/w212_h121_x106_y60_101298275_ffc8d4c5f8.jpg)

![4 Cluster der Minenindustrie [1] ● Mining industry clusters [1]](https://www.at-minerals.com/imgs/tok_b167f5ac78b195cab1edb069d0d44dd7/w300_h200_x400_y293_101298238_e5c33b98df.jpg)