China – Changes in the resources policy?

Summary: The Middle Kingdom dominates the metal resources markets. China's hunger for resources including numerous metals like aluminium, copper, nickel and iron ore has virtually doubled every ten years since 1980. Moreover, the country is the leading producer of critical resources like rare earths, bismuth and tungsten. In the following paper, the figures for China are examined and prominent Chinese mining companies profiled.

1 Introduction

In 2021, the resources sector accounted for a share of 27.4 % in China’s economic output. According to the 14th Five-Year Plan (2021 – 2025) of the People’s Republic of China, more emphasis is now being put on sustainable development in the resources sector. One focus is on energy savings in the steel sector and in the aluminium industry. Surplus capacities are to be reduced, new capacities controlled more strictly, and technologies modernized. Domestic mining is regarded as an important instrument for ensuring a reliable supply to industry. On the other hand, access to critical resources is to be improved with investment abroad. China remains open to supplying resources abroad, however, for certain critical resources like rare earths, export quotas will continue to be imposed.

In the EU as a whole as well as in the individual countries of the European Union, the focus for years now has also been on critical resources. The EU recently classified and rated 137 resources as critical [1]. For these resources, the EU is most heavily dependent on imports from China with 52 %, Vietnam with 11 % and Brazil with 5 %. Selected as a basis for the ratings was the import value in the EU for these products, which makes up 6 % of all goods imported into the EU. Fig. 1 shows a selection of the key supply countries for critical resources for the EU. China supplies 98 to 99 % of the rare earths (LREE and HREE), 93 % of the magnesium and 69 % of the tungsten, too. Brazil supplies 85 % of the niobium, Chile supplies 78 % of the lithium. South Africa leads supply of the platinum group metals (PGM) with 71 to 93 %. 64 % of the bauxite comes from Guinea.

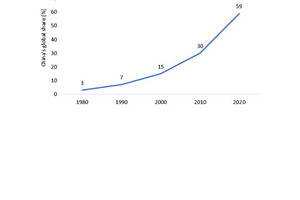

2 China’s hunger for resources

China has had a key impact on the demand for industrial metals over the last 20 to 30 years. Fig. 2 shows how China’s share in the global consumption of aluminium, copper, nickel and iron ore has changed since 1980. It can be seen that Chinas consumption has practically doubled every ten years. In contrast to other industrial countries, China is able to cover at least a substantial part of its demand for metals with its domestic production. Nevertheless, its imports of nickel, iron, cobalt, tin and copper ore or ore concentrates stand at a high 63 to 88 %. Accordingly, the global prices for resources are largely determined and influenced by China’s demand and the Chinese government’s interventions in the market. This has made China one of the key players in the metals markets.

Since 2010, around 11.5 to 19.0 bill. US$ per year have been spent on the exploration of mineral resources in China. In 2020, the figure totalled 12.6 bill. US$ after 14.4 bill. US$ in 2019. The biggest investments, however, were channelled into the exploration of oil and gas, accounting for 10.3 bill. US$ (81.7 %) most recently, while only 2.34 bill. US$ (18.3 %) went into the exploration of metals and all other minerals [2]. Fig. 3 shows the total investments in exploration in China in the years 2019 and 2020 for coal and the major metals. In both years, coal was at the forefront with 22.3 % growth. The biggest investments for non-ferrous metals in recent years were for the exploration of gold, zinc, copper, bauxite, tungsten, manganese, molybdenum and nickel. The biggest growth was reported for bauxite (+89.5 %) and manganese ore (+43.9 %), the biggest declines resulted for zinc (-40.3 %), nickel (-35.8 %) and tungsten (-21.3 %).

Unlike in earlier years, in Beijing the worldwide market conditions are closely monitored and the state ore and ore concentrate reserves drawn on in order to balance supply and demand [3]. In September 2021, for instance, China released relatively large reserves of copper, zinc and bauxite ore to counter a further increase in the price of these resources. According to information from the Chinese State Council, resources were even offered below market prices to small- and medium-sized smelting operations in China so as not to endanger the economic efficiency of these operations. In addition, China is endeavouring to increase its influence on the extraction of resources especially in Africa, Latin America, Central Asia and South and Eastern Europe to secure the supply to the country with low-cost resources. Relevant in this context is China’s “Belt & Road” initiative.

3 Situation in the mining industry

3.1 Rare earths

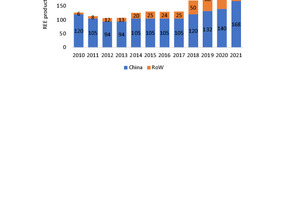

The global market for rare earths has changed considerably in recent years. On the one hand, the production of rare earths almost tripled from around 106 thousand tonnes per year (kta) in 2012 to 280 kta in 2021 (Fig. 4), on the other hand, China’s share in output has fallen since 2010 from 95 % to 60 %. This is primarily due to new production capacities in the USA, Australia, Myanmar and Thailand. Interesting, however, is also that China has increased its production output by 74 kta since 2012. Production levels in China have been defined with reference to quotas [4]. The highest production quotas in 2021 were reached by China Northern Rare Earth with 100.3 kta, followed by China Southern Rare Earth with 42.5 kta, Chinalco Rare Earth with 17.1 kta, Guandong Rising Rare Earth with 13.3 kta and China Minmetals with 7.7 kta. In 2021, China exported 107.9 kta. Also in 2021, Chinalco, China Minmetals and Ganzhou Rare Earth formed the China Rare Earth Group.

3.2 Lithium

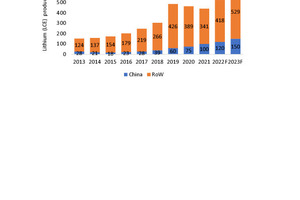

Most analysts expect that by 2030 the market for lithium will almost triple on the back of the rapid expansion of electromobility and the increased demand for batteries associated with this. Fig. 5 shows how the production of lithium (here as lithium carbonate equivalent or LCE) has developed in recent years. As a result of LCE processing capacities not being ready for operation especially in China, production and consumption were still throttled. China has now advanced to become the third-largest producer behind Australia and Chile, China’s share in global production has risen from 18 % to 23 %. China’s leading producers Gangfeng Lithium and Tianqi Lithium also occupy places in the TOP 5 of the international ranking. Moreover, the companies are also gaining ground at other locations worldwide [5]. Not least, China is now the biggest LCE-processor and producer of lithium ion batteries.

3.3 Gold

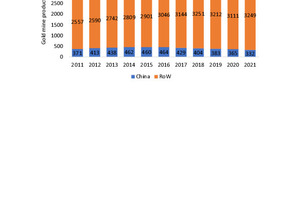

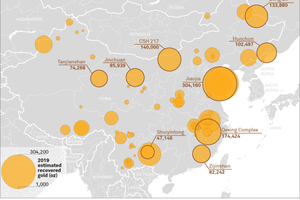

With a mine production of 332 t gold in 2021, China remains the world’s largest gold producer, just ahead of Russia and Australia. With regard to global shares, China, however, has dropped down (Fig. 6). Reaching 14.1 % in 2014, its share has fallen steadily to 9.3 %. This has to do with China’s lower mining output, but also with the increasing mining output of other countries. African countries, for instance, have increased their share from 22.9 % in 2011 to 27.4 %. In China, the gold mines are spread across several provinces, with a concentration in Shandong (Fig. 7). The leading mining companies Shandong Gold, China National Gold (CNG), Zhaojin Gold, Zhongjin Gold and Zijin Mining account for a good 40 % of the quantities mined in China. China is endeavouring to acquire shares outside the country. The attempt of Shandong Gold to take over the troubled TMAC Gold in Canada failed, however, because of a veto by the Canadian government. Instead it was sold to Agnico Eagle.

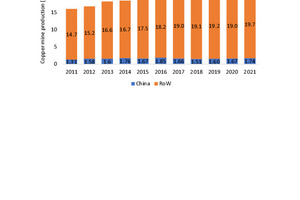

3.4 Copper

According to the International Copper Study Group (ICSG), in 2020 China was responsible for 50 % of the worldwide copper smelting, followed by Japan with 8 % and Chile with 6 %. Fig. 8 shows the mine production for copper metal since 2011. On account of decreasing copper content in the ore and fewer promising new projects and extensive stagnation from 2017 to 2020, the market has only developed relatively sluggishly. With a production quantity of 1.74 mill. tonnes per annum (Mta), China currently reaches only 8.1 % of the global mining output, after 9.5 % in 2014. The biggest copper concentrate producers in China include Jiangxi Copper, Zijin Mining, the Jinchuan Group, Yunnan Copper (Chinalco), China National Gold and Western Mining Co. S&P Global reports that Chinese companies are now involved in or have the majority rights in 52 projects in copper mining in Africa and Europe.

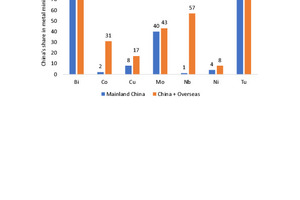

3.5 Other critical resources (Bi, Co, Mo, Nb, Ni, Tu)

As part of its autarchy efforts, as well as being involved with the above-mentioned metals, China is interested in other critical metals that are used, for instance, in the production of batteries (cobalt, nickel) or for metal alloys (bismuth, molybdenum, niobium, tungsten) for production of high-strength materials, permanent magnets, high-performance magnets and in medical technology. Fig. 9 shows China’s share in global mine output in China and abroad. For copper (Cu), for example, China can increase its market share from 8 % to 15 % with shares in mining operations in DRC, Zambia, Chile, Mexico, Serbia and Australia. With regard to cobalt mining (Co), China has been able secure mines especially in the DRC, for niobium (Nb), there are two mines in Brazil. Nickel (Ni) is also mined in Australia, Indonesia, the Philippines and Zambia, molybdenum (Mo) in Peru.

4 China’s leading mining companies for metal ores

4.1 China Gold International Resources

China National Gold Group has a 40.01-% stake in China Gold Intern. The company operates two mines in China, the Changshanhao (CSH) mine in Inner Mongolia in the north of China and the Jiama Polymetall-Copper-Gold mine in Tibet (Fig. 10), 68 km northeast of Lhasa. In 2021, a total of 244.3 thousand ounces of gold (kOz) and 95.3 kta of copper were produced. Since 2011, the company’s sales have increased with average annual growth rates (CAGR) of 13.8 % to 1.14 bill. US$.

4.2 China Molybdenum (CMOC)

CMOC is a listed company that was only founded in 2006. The company is a globally important copper producer as well as being one of the leading producers of tungsten, cobalt, niobium and molybdenum, with subsidiaries and stakes in Asia, Africa, South America, Australia and Europe. In 2021, the company reached the 15th place among the worldwide mining companies and is one of the three largest base metal traders in the world. In the Tenke Fungurume Mine in the DRC, 18.5 kta cobalt were extracted in 2021 (Fig. 11). It should be mentioned that CMOC has joined the Fair Cobalt Alliance (FCA). Copper production stood at 209.1 kta, tungsten production at 8.7 kta, that for niobium at 8.6 kta. In China, 16.4 kta molybdenum is also produced.

4.3 China National Gold Group

China National Gold was established in 2003 from a merger of several companies in China. In the meantime, the Group has 57 subsidiaries with a total of 48 mine operations and six refineries. Outside China, the Group is active in the Republic of Congo, Kyrgyzstan and Russia. One of the biggest companies in the Group is Zhongjin Gold Mining, which alone has 25 mining operations (Fig. 12). In 2021, Zhongjin Gold extracted 20 t gold and refined a total of 84.98 t gold, an increase of 14.6 % on 2020. Zhongjin Gold also produced around 81.3 kta copper concentrate and 401.7 kta electrolyte copper.

4.4 CITIC Metal

CITIC Metal, which belongs to the CITIC Group founded in 1979, has made a name for itself in just a few years by trading with commodities like niobium, iron ore and non-ferrous metals and strategic investments in the mining sector. The company’s investments include the Brazilian CBMM, the worldwide largest niobium producer, the Las Bambas copper mine in Peru and Ivanhoe Mines with the Kamoa-Kakula copper mine (Fig. 13) and Kipushi zinc-copper mine, both in the DRC, and the Platreef PGM Polymetal mine in South Africa. It also has a majority stake in China Platinum. CITIC Metal imports 80 % of the niobium demand of the Chinese steel industry.

4.5 Gangfeng Lithium

Gangfeng Lithium has advanced to become the world’s leading company in the extraction of lithium suitable for batteries. The LCE capacity was 100 kta in 2021, by 2025 capacity is set to grow to 300 kta, the aim in the long term being 600 kta. 20 % of this is to come from the recycling of batteries in the long run. In China, lithium is extracted from the Ningdu Heyuan Spodumene Mine and Quinghai Yiliping (brine processing). Outside China, the company has stakes in Mt Marion (Fig. 14) and Pilgangoora in Australia, Sonora in Mexico, Mariana and Cauchari-Olaroz in Argentina, Avalonia in Ireland as well as Goulamina in Mali.

4.6 Jiangxi Copper

With an annual output of over 200 kta, Jiangxi Copper is one of the largest copper producers in mainland China. The company’s most important copper mines include the mines in Deixing (155.2 kta capacity), Yongping (18.5 kta), Chengmenshan (14.5 kta) and Wushan (12,2 kta). Jiangxi Copper is also active in the production, processing and sale of copper cathodes, copper rods and copper wire and other related products. The company also produces precious metals like gold (78.6 t in 2020) and silver (1126 t in 2020), as well as rare metals and minerals like molybdenum, selenium, rhenium, tellurium and bismuth. The operation of a tungsten mine is planned in Kazakhstan.

4.7 Jinchuan Group

The Jinchuan Group is one of the largest Chinese mining enterprises. Worldwide, it is the third largest producer of nickel with a production capacity of 200 kta. For cobalt, the company reaches a production capacity of 10 kta, making it, behind Glencore, Gecamines and China Molydenum, the fourth largest producer in the world. The company’s assets include numerous operations and investments in China and abroad (Fig. 15). Nickel is extracted in Australia, Indonesia, on the Philippines and in Zambia, copper in the DRC, Zambia and Mexico, cobalt in the DRC. In the foreign mines consolidated in Jinchuan International in the DRC and Zambia, 61.3 kta copper and 3.379 kta cobalt were extracted in 2021 after 73.1 kta and 5.07 kta in the previous year.

4.8 MMG Limited

The main shareholder of MMG is the China Minmetals Corporation (CMC). CMC was founded in 1950 and is one of the largest multinational state enterprises in China. MMG has its company headquarters in Melbourne/Australia and is listed on the Hong Kong stock market. In 2021, a total of 339.7 kta copper and 24.8 kta zinc were extracted. Besides these, gold, silver, lead and molybdenum were produced. MMG’s most important mines are the Las Bambas copper mine (Fig. 16) in Peru, in which it holds a 62.5-% stake, and the wholly owned Polymetal Kinsevere mines in the DRC as well as Dugald River and Rosebery in Australia. In the Kinsevere mine, copper production is being increased, and the plan is to extract cobalt, too. In 2021, MMG generated sales totalling 4.255 bill. US$ (+40 % on the previous year).

4.9 China Northern Rare Earth High Tech Group (REHT)

REHT, formerly Inner Mongolia Baotou Steel Rare-Earth (Group) HI-TECH Co., is the biggest supplier of rare earth products. In 2021, with 100.3 kta, it reached almost 62 % of Chinese production. The company is involved mainly in the production and sale of rare earth resources, rare earth functional materials and rare earth application products. REHT is concentrating on extending the value creation chain for rare earths, the implementation of energy-saving motors, new energy vehicles and rare earth catalytic converters. In a JV with Qingdao Sino-Canada Special Co., it has invested in a rare-earth high-performance motor project with permanent magnets. In addition, work has been started on the construction of a rare earth catalytic converter project for vehicles.

4.10 Shandong Gold Mining

Shandong Gold was founded in the year 2000 and listed on the stock market in Shanghai in 2003. The company owns gold mines in the provinces Shandong, Fujian, Gansu and Inner Mongolia. In Argentina, it has a stake in a 50/50 joint venture with Barrick Gold at the Veladero gold mine (Fig. 17). In 2021, 344 kOz gold was produced there. In 2020, Shandong Gold’s attempt to take over the trouble TMAC Gold in Canada was vetoed by the Canadian government.

4.11 Western Mining Co. (West Mining)

West Mining was founded in Xining in 2000 and is part of Western Mining Group. The company owns numerous mines, including the Qinghai Xishishan lead-zinc mine, a gold mine and the Shuangli ore mine in Inner Mongolia as well as the Sichuan Pangcun silver polymetal mine. At the Yulong copper mine (Fig. 18) in Tibet, the company is shareholder with Zijin Mining and other companies. After the mine extension, in 2021 around 109.5 kta copper was produced from copper concentrate. With proven reserves of 6.5 mill. t, Yulong Mine is the biggest copper mine in China. These reserves enable operation up to 2036.

4.12 Yunnan Copper (Chinalco or Chalco)

In 2007, the Aluminium Corp of China (Chinalco) had taken over the majority stake in Yunnan Copper for 1 bill. US$. Yunnan Copper was founded in 1958 and is the third largest copper producer in China. The company operates 11 mines and has six smelting plants. The production quantity of copper in copper concentrate stood at around 120 kta at the last count.

4.13 Zijin Mining

Zijin Mining is a multinational mining group. Worldwide it is involved in the exploration and development of copper, gold, zinc and battery metals as well as in the research of engineering technologies. The company is listed on the stock market in Shanghai and Hong Kong and operates mines in 13 Chinese provinces and 13 countries outside China. In 2021, 540 kta copper, 47,5 t gold and 396 kta zinc were produced. The company turnover increased to 225.1 bill. RMB (34.9 bill. US$). In March 2021, four months ahead of schedule, Phase 2 of the Kamoa-Kakula copper mine (Fig. 19) in the DRC went into operation. There 340 kta copper are already set to be extracted in 2022. The company is also pushing ahead with another big copper project with Xanadu Mines in Tibet.

5 Outlook

Without doubt, China is in the process of increasing its market power for metal ores and resources. The activities of the Chinese mining giants like China Molybdenum, CITIC Metal, Jinchuan Group, MMG Limited, Zijin Mining and Gangfeng Lithium provide plenty of examples. China is first and foremost ensuring supply to satisfy its own hunger for resources. In the meantime, however, economic considerations from supply and demand to pricing are taken into consideration. The Chinese government expects its companies to follow the “One Belt One Road” strategy. It remains to be seen what that means for cooperation with Russia, which is becoming increasingly isolated and seeking buyers for its resources. China’s imports of coking coal from Russia, for instance, reached record-setting levels in April 2022.

Literature

[1] EU Commission: Strategic dependencies and capacities. SWD (2021) 352 final. 05.05.2021, Brussels/Belgium

[2] Li, X. et. al.: China mineral resources 2021. Ministry of Natural Resources of the PRC. Geological Publishing House 2022, Beijing/China

[3] Harder, J.: China’s surplus capacities – Reorientation of the mining industry. AT MINERAL PROCESSING 7-8/2016, pp. 58-72

[4] Harder, J.: Technical metals – New focus on rare earth elements. AT MINERAL PROCESSING 10/2018, 10, pp. 76-88

[5] Harder, J.: Boom – New era for lithium. AT MINERAL PROCESSING 06/2017, pp. 56-67

Author:

Dr.-Ing. Joachim Harder

OneStone Consulting Ltd., Varna/Bulgaria

www.onestone.consulting

Joachim Harder studied process engineering at Braunschweig University of Technology and earned his Ph.D. there. After more than 10 years working in industry in various management posts, in 1997 he established the consulting company OneStone Consulting. Dr. Harder is an acknowledged expert in international marketing, specializing in market analysis for business segment strategies. He is the author of diverse publications and a popular conference speaker.

![1 Supply countries for critical resources [1]](https://www.at-minerals.com/imgs/1/8/2/8/8/4/0/tok_137130bf3d181054aee44f52ff9a2c3a/w300_h200_x600_y300_01_Bild1_CriticalResources1L-184c8cb3c406b838.jpeg)

![3 China’s exploration investments [2]](https://www.at-minerals.com/imgs/1/8/2/8/8/4/0/tok_5674666ffd53e4ea52fe33ca857e1315/w300_h200_x421_y297_03_Harder_expl-invest-364632a7d51953d1.jpeg)