Boom - New era for lithium

Summary: Triggered by a boom for electric vehicles, the market for lithium is expected to triple within 10 years. The following report outlines the background to this development and discusses the lithium mining industry and its production capacities and capacity expansion projects.

1 Introduction

When the car manufacturer Tesla put its Gigafactory into service recently, it marked the beginning of a new era for lithium and for the production of batteries. From 2018 onwards, the 5 billion US$ factory in Sparks/Nevada, will be producing lithium-ion battery cells at a planned annual production capacity of 35 gigawatt-hours (GWh). That’s enough for about 500 000 electric cars and corresponds to almost 50 % of the current global lithium-ion battery production capacity. Prices for battery cells are falling faster than predicted, which will greatly boost the demand for electric cars. Tesla Motors is planning to build more battery factories together with its cooperation partner Panasonic. In addition, the hitherto leading companies for electric car batteries LG Chem of South Korea, Foxconn and BYD of China, as well as other companies, are building or planning new capacities in the GW range.

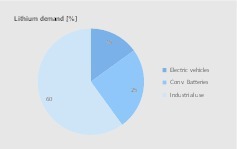

Due to the market outlook for electric cars, the demand for lithium (LCE = lithium carbonate equivalent) is forecast to almost triple from 184 kt in 2015 to 534 kt in 2025 [1] (Fig. 1). In 2015 and 2016 demand rose more strongly than supply, so that in the meantime lithium carbonate prices (99.5 % purity) have climbed from 6500 US$/t to over 20 000 US$/t. In the long term, a price of approximately 12 000 US$/t is expected. In 2015, electric vehicles only accounted for about 15 % of the demand for LCE (Fig. 2). By the year 2025 this proportion is expected to grow to 52 %. The largest amount of LCE (60 %) is currently still used for industrial applications (lubricants, metal powders, glass, ceramics, chemicals, pharmaceuticals, gas cleaning, etc.). Lithium batteries for consumer electronics such as smartphones, tablets, laptops and battery powered tools account for a 25 % share.

2 Lithium properties and mining

The silvery-white lithium is now one of the most coveted raw materials in the world. The light metal is not naturally found in elementary form due to its high reactivity. Lithium has a low density and a very low standard electrode potential, which means that it can be used as an anode in batteries. Lithium batteries have a high energy density and generate a high voltage. The light metal has become indispensable, especially for rechargeable batteries. Lithium is offered in various forms: lithium carbonate (Li2CO3) accounts for over 50 % of all products, lithium hydroxide makes up a further 20 % and the remaining amounts are lithium concentrate (Li2O), lithium chloride and organometallic compounds such as butyllithium and methyllithium.

Lithium is present in the earth’s crust at an abundance of 0.006 %. It is thus more common than lead, tin and cobalt, but extraction is difficult because of its thin distribution. The global reserves are estimated to be 101 million t (LCE), with resources estimated at 273 million t. Lithium occurs in rocks as lithium pegmatite. The most important ores are spodumene (triphanum, LiAl[Si2O6]) and lepidolite (K(Li,Al)3[(Al,Si)4O10](F,OH)2). The lithium oxide contents in the ores are usually only between 1 and 3 %. In salt lakes or salt pans (aka brines), lithium salts are widespread, especially lithium chloride. The lithium content of such deposits can be up to 1 %. The currently highest known concentration of 0.16 % has been measured in a Chilean deposit.

2.1 Mining countries

According to Deutsche Bank Markets Research [1], the production of LCE will increased from 152 kt in 2013 to 534 kt in 2025 (Fig. 3). The largest producing country is now Australia with an output of 69 kt in 2016, before Chile with 64 kt. Growth forecasts for Australia predict a rise to 206 kt by 2025, while Chile’s output is only expected to grow to 100 kt. This would mean that Chile will be overtaken by Argentina, whose output is expected to climb to 153 kt. China is currently in front of Argentina with a quantity of 23 kt, but this figure is only expected to increase to 43 kt by 2025. The Deutsche Bank expects the remaining countries, including the United States, Brazil, Bolivia, Canada, Mexico, Austria, Portugal, Serbia and Zimbabwe to grow from the 2016 figure of 15 kt by only 21 kt to 36 kt in 2025. However, given the projects in hand in these countries, this forecast is likely to be an underestimate.

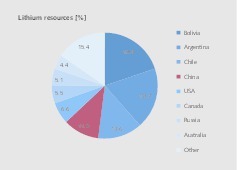

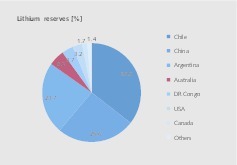

It is currently thought that the world’s largest resources of 54 million t (19.8 %) are located in Bolivia (Fig. 4). Bolivia is still ahead of Argentina and Chile, which account for 18.7 % and 13.6 % of the world’s resources. The three countries are also referred to as the lithium triangle. The resources there account for 52 % of the global deposits and all of them are located in brines. Other important countries include China, the USA, Canada, Russia and Australia. The remaining countries are Brazil, DR Congo, Mexico, Portugal, Serbia and Zimbabwe. Neither Bolivia nor Russia are included in the statistics for lithium reserves (Fig. 5). These show the three countries Chile, China and Argentina to be the leaders, together accounting for 86 % of the world’s reserves. In Bolivia the deposits are contaminated by high amounts of magnesium, and the lithium content is comparatively low, so that some experts do not consider mining to be economically feasible at the present time.

2.2 Technologies

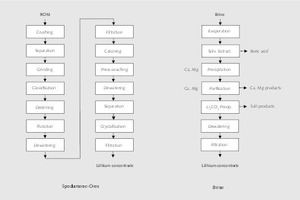

The beneficiation of lithium ores and brines is carried out by completely different methods. For the treatment of spodumene ores, a thermal process with temperatures above 1000 °C is necessary (Fig. 6, left) in order to allow leaching of the Li constituents. Prior to this, the ore is crushed, ground, floated and dewatered to separate the gangue. The wet concentrate or spodumene concentrate has lithium oxide contents of about 6 %. The enrichment of the lithium from the wet concentrate is usually carried out in a pressure leaching process with hydrocarbonation in alkaline media such as sodium carbonate (soda). Other methods involve a sulfuric acid process. After the carbonation, further purification steps and a crystallization of the lithium carbonate take place. The lithium carbonate is available today in two degrees of purity, 99.5 % LCE and 98 % LCE, with a significant price premium being achieved with the high-quality product.

The extraction of lithium carbonate from brines (Fig. 6, right) initially requires a concentration of the salt solutions. Besides lithium, such deposits contain large amounts of potassium, magnesium and calcium, as well as chlorides, sulfates and borates. Concentration is achieved by evaporation of water in large salt lagoons or ponds. The beneficiation process begins with an extraction to precipitate out the borates. In further purification steps, calcium and magnesium are precipitated out. Subsequently, the precipitation of lithium carbonate is carried out by addition of sodium carbonate. The poorly soluble lithium carbonate is subsequently dewatered and filtered. Overall, the lithium preparation from salt solutions is less complicated. However, this essentially depends on what types of impurities are present.

2.3 Production costs

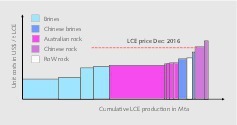

The processing costs for lithium carbonates (LCE) differ significantly. The lowest production costs are achieved by extraction from brines (Fig. 7). The cost leaders are currently salt pans in the Atacama Desert in the Antofagasta region of northern Chile (Fig. 8). There, the average production costs were below 2500 US$/t of LCE. The costs at the salt pans in Argentina (Olaroz and Salar del Hombre Muerto) are estimated to be slightly higher. For 2025 it is assumed that in some cases low production costs of less than 2000 US$/t of LCE will be possible. For the extraction from spodumene ores, the Greenbushes mines in Western Australia have the lowest production costs, but these are still significantly higher than the cost of extraction from salt pan brines. Companies in China have the highest production costs, both for the extraction from brines (salt lakes in Tibet) and from ores.

3 Mining companies

So far, only comparatively few companies are involved in the production of lithium. In 2014 just 4 companies accounted for 86 % of the global production of about 160 000 t of LCE. Of these, Talison had a share of 31 %, SQM (La Sociedad Química y Minera de Chile) 22 %, Albemarle 20 % and FCM 13 %. Chinese companies produced a further 13 %, while other companies accounted for only 1 %. In this context it is important to note that the market leader Talison is a 50/50 joint venture of Albemarle and the Tianqi Lithium Corporation of China. Accordingly, Alberarle controls more than 35 % of global production. Fig. 9 shows how the production shares of the companies are divided into production from ores and brines. Talison accounts for 78 % of the world’s production from ores, while SQM is the market leader with 36 % of production from brines, followed by Albemarle with 34 %.

Talison Lithium has two production locations. Firstly, the company owns the Greenbushes mine in Western Australia, about 250 km south of Perth and 90 km southeast of the port of Bunbury, an important ore shipment harbour. Lithium carbonate has been extracted at this mine for more than 25 years. Tin and tantalum have been mined for a considerably longer time. The Greenbushes pegmatite deposit is over 2500 years old. Greenbushes is referred to as a “world class mine” because of the high lithium content in the ore and the large reserves. The mine capacity is to be doubled to 110 kt of LCE by 2020. In addition to Greenbushes, Talison owns Salt Pan 7 in the Atacama region of Chile, for which a license for an increase in production was granted in 2016. The joint venture partner Tianqi has a LCE production capacity of over 34 kt in China and a capacity of 21 kt of lithium hydroxide in Kwinana, Western Australia.

SQM is the cost leader in the production of lithium (LCE) from the Salar de Atacama salt pan (Fig. 10). In 2016, the company achieved a turnover of 1.94 billion US$ with a gross yield of 611 million US$. SQM owns mining concessions in Chile for a land area of more than 3 million hectares (ha), of which more than 80 000 ha are for lithium mining. The total reserves are estimated to be 6.9 million t of lithium oxide. The yield is between 28 % and 40 %. The operative plant with the Salar del Carmen processing system has a production capacity of 48 kt of lithium carbonate and 6 kt of lithium hydroxide. In 2015 about 39 kt of lithium products (LCE) were extracted, whereby lithium is actually mined as a by-product in the production of potassium or potash fertilizer. However, the lithium business has recently proved to be more sustainable than the potassium business.

Albemarle Corporation, based in Charlotte, USA, is planning a production capacity of 165 kt of LCE by 2021. The company entered the lucrative lithium business in 2015 through the acquisition of Rockwood. At the moment, the company owns 3 plants, although this includes a 50 % stake in JV Greenbushes. In 2017, the plant in the Atacama region of Chile has a capacity of 44 kt, Greenbushes in Australia has 40 kt and Clayton Valley in the USA has 5 kt. In 2016, Albemarle additionally took over Jiangxi Jiangli New Materials, which is a lithium salts producer in China. FMC Corporation is the world leader in butyllithium production. In 2014, butyllithium made up 34 % of all lithium products, while lithium carbonate and lithium hydroxide each accounted for 19 %. In 1995, FMC acquired the Salar del Hombre Muerte saltpan in the high Andes, 850 km north-west of Buenos Aires in Argentina.

The first new plant to be put into service outside of China in the last 20 years is Orocobre Limited’s Salar de Olaroz plant (Fig. 11) in Argentina. The project is located in an area of 63 000 ha in the arid region of Puna in Argentina’s north-western province of Jujuy. A total of 1.2 million t of resources have been proven at this location. The project started in 2007 with Toyota as a partner. The project costs amounted to approx. 230 million US$. In Phase 1, a production capacity of 17.5 kt of LCE was developed. By 2019, phase 2 should add a further capacity of 22.5 kt. Orocobre expects that lithium carbonate can be produced for a period of more than 40 years. The production cost will be around 2000 US$/t of LCE.

In addition to the above firms, there are a number of companies in China with lithium production capacities, prominent among which are Tianqi Lithium, Ganfeng Lithium, China Minmetals, Qinghai Salt Lake, Qinghai East Taijinar Lithium Resources, ZhongHe and CITIC Guoan. In the rest of the world (RoW), only small producers have so far been active: Bikita Minerals in Zimbabwe, Manono-Kitolo in the DR Congo, Sociedade Minira de Pegmatites in Portugal and the Companhia Brasileira de Litio and the Arqueana de Minerios e Metals in Brazil.

4 Capacity growth

The good business prospects for lithium and the limited current production capacities have attracted a large number of companies to the sector. However, some projects were begun more than 10 years ago and then put on hold in the meantime due to overcapacities and poor prices, but have now finally been recommenced due to the growing market potential. Fig. 12 shows a projection of the growth in capacity and the possible capacity utilisation for the coming years. This anticipates that production capacity will increase from 235 kt in 2013 to 630 kt in 2020. This corresponds to an average annual growth rate of 15.1 %, while demand in the considered period is forecast to only increase by an average of 13.3 % annually. Accordingly, after an intermediate high of 63.8 % the capacity utilisation will decrease to 57 %.

In the following, various projects will be presented. Some of these projects only concern spodumene concentrate (6 % Si2O). The development plans of the established producers have already been mentioned. Talison plans to double its capacity to 110 kt by 2020, which will mainly take place at the Greenbushes mine in Australia. SQM, together with Lithium Americas, is going to develop the Minera Exar project (Cauchari-Olaroz) in Argentina to a capacity of 50 kt by 2019. Albemarle intends to expand its 3 existing mines to a capacity of 165 kt by 2021. In addition, the La Negra project in Chile is to be expanded by 20 kt of LCE. FMC plans to expand its lithium-hydroxide capacities to 30 kt by 2019. According to a market report by the Deutsche Bank [1], the output of mines in China is only expected to grow from 22.9 kt in 2016 to 34.9 kt in 2020.

The projects due to come on line in 2016/2017 include Galaxy’s Mt. Cattlin project and Neometals’ Mt. Marion project. The Mt. Marion Project is located about 40 km southwest of Kalgoorie in Western Australia. The joint owners are Neometals (13.8 %) together with Mineral Resources and Ganfeng Lithium with stakes of 43.1 % each. The project went into operation in November 2016 (Fig. 13). A first product shipment of 15 000 t of lithium concentrate (6 % Li2O) took place in February 2017. The anticipated annual output is 400 000 t, which corresponds to about 30 kt of LCE. The quantity of resources has recently been re-assessed at 77.8 million t at 1.37 % Li2O. Galaxy Resources’ Mt. Cattlin project (Fig. 14) reached its nominal capacity of 210 t/h of Li2O concentrate in April 2017. The project is located near Ravensthorpe in Western Australia. The plant is designed for 800 kt of 5.5 % Li2O concentrate per year.

In Australia there are other promising new projects such as Altura’s Pilwayoora project with 13 kt of LCE and Pilbara Minerals’ Pilgangoora project with 48 kt of LCE. Pilbara plans to commission the mine later this year and make the first deliveries in 2018. In Brazil, AMG Lithium’s Mibra project is to be put into operation in the 1st quarter of 2018. Technology from Outotec is installed there (Fig. 15). The mine will initially produce 14 kt of LCE and will increase this to 20 kt of LCE at full capacity, in the form of lithium carbonate and lithium hydroxide. The mine is located 225 km northwest of Rio de Janeiro and about 300 km from the Port of Santos. In Canada, Nemaska Lithium’s Whabouchi project has already been put into operation. The mine is located in the Eeyou Istchee James Bay region, 300 km north of Chibougamau. The rated annual output is 213 kt of concentrate with a 6 % Li2O content.

In addition, there are numerous projects for which feasibility studies have been carried out or where pilot plants are being tested. These include the Enirgi Group’s Rincon projects in Argentina, Eramet’s Centinario project in Argentina, Neo Lithium’s 3Q project in Argentina, Galaxy Resources’ Sal de Vida in Argentina, Li3 Energy’s Maricunga project in Argentina, Salar de Uyuni project of Corporación Minera de Bolivia (COMIBOL) in conjunction with the German k-UTEC Salt Technologies in Bolivia, Bacanor’s Sonora project in Mexico, Lithium Americas’ Kings Valley project in Nevada/USA and Rio Tinto’s Jadar project in Serbia.

In Europe alone there are 7 different projects. The Jadar project is located near the town of Loznica, about 140 km from Belgrade. The deposit was discovered in 2004 and is so large that it could cover 10 % of the global lithium supply. However, the first project in Europe to be put into operation could be European Lithium’s Wolfsberg mine (Fig. 16). This mine has an ore volume of 6.3 million t at 1.17 % Li2O and is located in the Austrian state of Carinthia, 270 km south of Vienna. As from 2019 it will produce spodumene concentrate, and a plant for lithium carbonate is to be put into operation at a later date. Two other interesting projects are Avalonia Li in Ireland, which is being undertaken by International Lithium and Ganfeng Lithium, and the Zinnwald Project near Dresden/Germany, in which Bacanora Minerals has a 50 % stake. Other projects are in progress in the Czech Republic, Finland and Portugal.

5 Prospects

In some places, people are already speaking of the new lithium age due to the fact that lithium or more exactly lithium-ion batteries allow the storage of large amounts of energy, which is essential, for example, if a substantial portion of our power supply is to be provided by solar and wind energy. However, in medium-term scenarios covering the period up to 2025, the storage of these alternative energies does not yet play such an essential role. Lithium-ion technology is currently focused on the automotive industry, mobility and clean technologies. which certainly provides enough reason for speaking of new era for lithium. If in a few years time large-capacity energy storage becomes a central topic, we will also speak of the lithium age.