Construction equipment industry stands on solid ground

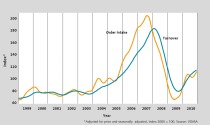

02.03.2022The order intake in the construction equipment industry allows manufacturers with production sites in Germany to look forward to 2022 with peace of mind. When companies will be able to achieve turnover, on the other hand, is an open question, as materials continue to be in short supply and supply chain problems are delaying the production of construction equipment. The statistics clearly show a gap between incoming orders and turnover.

© Pixabay

In 2021, the construction machinery and building material plant sector achieved a 22-percentage increase in turnover of 16,7billion € compared to the same period of the previous year. The construction equipment sector achieved a nominal increase of 18% to 12,4 billion €. Incoming orders were up 53 %. Export turnover was 8,1 billion €, domestic turnover was 4,3 billion €. It is gratifying that building construction, earthmoving and road construction machinery show a homogeneous distribution. Road construction machinery achieved the highest increase in turnover with 22 %. This development catapults the industry back to the record level of 2018/19. Nevertheless, expectations for turnover are cautious this year. The biggest risk, in the experience of many manufacturers, lies in the ongoing disruptions to supplies. "We are pushing a wave of orders ahead of us that we will probably have to carry into 2023 if the situation remains like this," fears Joachim Strobel, chairman of the VDMA's construction equipment division. "Despite full order books, the industry can only expect a maximum increase in turnover of 7 % for the current year. Profit will also fall short of our expectations because we have to contend with enormously increased costs."

Economic stimulus programmes boost the USA and Europe

The USA, Europe and China remain the most important market regions and together account for 75 % of the global market. Construction equipment sales in 2021 increased by 30 % in the US and 28 % in Europe compared to the same period last year. China weakened with a 7 % decline. Globally, sales rose 18 % overall, 32 % excluding China. Nevertheless, the country remains the largest single market. The US market is promising for the next few years. Thanks to extensive economic stimulus programmes, golden times could dawn for the construction sector in the United States. In Europe, too, the economic stimulus programmes launched in the pandemic will have a supporting effect in the next 2 to 3 years. In China the development is uncertain, the risk of a real estate crisis is still present there.

In Germany, sales of construction equipment rose by almost 10 % last year, and demand from the customer industries remains high in the current year. This boom will even be able to defy the shortage of skilled workers and material bottlenecks.

Return to personal meetings at trade fairs

At the top of the agenda for construction equipment manufacturers are the tasks of reducing CO2 and advancing digitalisation. These are also key topics at the leading trade fairs for the construction equipment and building materials plant sector this year. ceramitec in June, glasstec in September and bauma in October will showcase trend-setting developments. "We are all looking forward to our presence trade fairs. At last, we can again show on a large scale what technical progress we have already worked out so that we can achieve the climate policy goals," emphasises Franz-Josef Paus, Chairman of the VDMA Construction.