Is Germany’s position as an industrial base under threat?

How is Germany’s doing as an industrial base? Its current standing is hotly contested by politicians. But let’s take a look at the facts. Industry faces enormous changes and strategic decisions are needed for the future. Besides investment, highly qualified specialists are crucial.

1 Development of business and industry in Germany

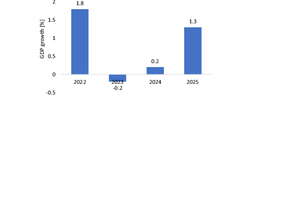

Germany’s foreign trade is suffering because of the weak global economy. This year, 2024, Germany’s real gross domestic product (GDP) will reach roughly the same volume as the previous year. Moderate growth in consumption has been registered, the rate of inflation fell to 1.6 % in September, energy prices dropped further, but all this contrasts with a substantial decline in investment. In the latest World Economic Outlook (WEO) issued by the International Monetary Fund (IMF), a forecast of 0.2 % economic growth for Germany for 2024 has been hazarded, following on from -0.2 % in the previous year and forecast growth of 1.3 % for 2025 (Fig. 1). With this, Germany falls short of the growth in the Eurozone (0.9 % in 2024 and 1.5 % in 2025) and the other developed economies. Even Japan is set to achieve +0.7 % in 2024 and 1.0 % in 2025, while the USA will likely report a GDP of 2.6 % in 2024 and 1.9 % in 2025.

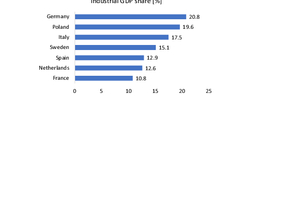

Is Germany lagging behind in the global economy, is it ultimately threatened with deindustrialization? According to figures from Eurostat for 2023, Germany reached with 20.8 % the top figure for the gross value added for industry, measured against the economy overall (Fig. 2). It is followed by Poland, Italy, Sweden and Spain, only then come the Netherlands and France. The EU-27 member countries averaged a 16.8 % share of industry in the gross value added. It should also be noted that numerous other upstream and downstream sectors of the economy are closely intertwined with industry. These include, for instance, associated services like outsourced engineering and logistic services that are not assigned to the producing sector in the statistics. If the services of these providers are included, then in Germany, according to figures issued by the Federal Statistical Office, almost 40 % of the entire value added is generated by the industry networks.

2 Decline of industries or branches of industry in Germany

Up to 2001, more coal was mined in Germany than imported. The Prosper-Haniel mine (Fig. 3) owned by Ruhrkohle AG (RAG) was the last mine to be closed in December 2018. But the portends of such problems were apparent much earlier. Since the 1960s, the operating costs in West German coal mining had been much higher than the revenues obtained on the market. Coal subsidies were introduced as non-subsidized coal mining became unprofitable. In 2010, the average market price was 85.33 €/t coal equivalents, in contrast the mining costs amounted to around 160 €/t coal equivalents. The subsidies were stopped in 2018. Since then, coal has been completely imported. In 2023, imports stood at 31.8 million tonnes (Mta) coal equivalents. According to Destatis, the index for the import prices has more than doubled from 150.3 in December 2018 to 316.7 in January 2023.

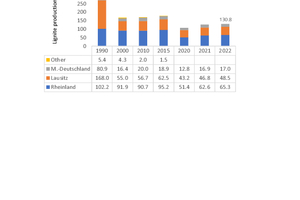

For lignite, the situation is considerably better as lignite can be extracted in surface mining (Fig. 4). The tonnages mined in the lignite-mining areas in Germany since 1990 are shown in Fig. 5. After 356.6 Mta in 1990, the tonnages still reached 130.8 Mta in 2022. Germany therefore produced a bit more than 58 % of the total EU production of 224 Mta, with Poland in second place with 18 %, Czechia (13 %), Bulgaria (9 %) and Romania (7 %). But by 2038, the last three lignite mining fields in Rhineland, in the Lausitz region and in Central Germany will cease extraction – probably in 2035, i.e. in around ten years, when the German law to reduce and end coal-fired generation (Coal-fired Power Generation Termination Act – KVBG) means closure by 31.12.2038 at the latest. In the KVBG, the major lignite plants and their final closure dates are listed individually.

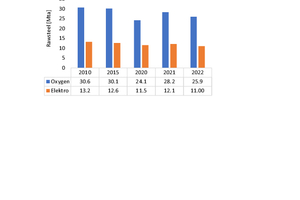

As a primary industry, the German steel industry plays an important role in the industrial value creation chains in Germany. With 36.9 Mta raw steel (2022), the Federal Republic of Germany is the biggest steel producer in the EU (Fig. 6).Sales revenues have increased to € 55.2 bill. The number of employees has fallen since German reunification from 179 000 in 1990 to 81 000. The steel industry’s annual results for 2023 are worrying. Steel production fell to a historic low. An especially drastic fall in the past year has been registered for the production of electric steel (Fig. 7). With a minus of around 11 % to 9.8 mill. t, this even fell below the low point in the financial crisis. Sluggish building activity and high electricity prices have shown for this electricity-intensive production route that the green transformation of the steel industry and the shift away from blast furnaces are problematic.

3 Investments and emergent industries in Germany

Commissioned by the Federation of German Industries (BDI), in September 2024, a study on the topic “Transformation paths for Germany as an industrial nation” was compiled by the Boston Consulting Group (BCG) in conjunction with the German Economic Institute (IW) [1]. In this, cornerstones for a new industry policy agenda have been elaborated. Germany is falling back as a base for industry in structural terms – for two thirds of the key indicators, it lags behind relevant competitors. Fig. 8 shows a survey of market attractiveness and competitiveness. The key would be to get into sectors with high attractiveness and high competitiveness (grey area). Examples are robotics, hydrogen technology and electric cars. For cloud computing, semi-conductors and batteries as well as the CCUS technologies, Germany in contrast trails far back. For recycling and 3D printing, Germany is ahead but the market for these is not particularly attractive.

To build up an independent European industry for microelectronics, in the view of Strategy&, PwC’s global strategy consulting team, Germany would have to invest € 115 bill. over the next ten years to become more digitally independent. So far, the market for semi-conductors has been dominated primarily by the USA, Taiwan, South Korea, Japan and China. But in Magdeburg, Intel wants to invest more than € 30 bill. in a new semi-conductor plant, whereby the start of construction planned for 2024 will probably be postponed by 2 years. The US American semiconductor manufacturer Wolfspeed and the German company ZF Friedrichshafen are planning to jointly build a chip plant in Saarland. The Taiwanese semiconductor manufacturer TSMC (Taiwan Semiconductor Manufacturing Company) wants to get involved in Dresden with an investment worth billions to set up a chip production facility. Also involved in the project are Bosch, Infineon and the Dutch-based NXP. Expected are investments totalling at least € 10 bill. Germany will hold an around 50-% stake. The European Commission has given the green light.

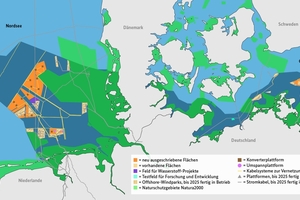

The energy transition is changing Germany. The share of renewable energies in the electricity sector has increased clearly from 46.2 % at the last count to 51.8 % in 2023. For the first time, more than half of the electricity needed in Germany has been supplied from renewable energy. In 2023 a total of 272.4 bill. kWh electricity was generated from renewable fuels. With a yield of 142.1 bill. kWh, wind energy made the biggest contribution [2]. In 2023, 61.2 bill. kWh electricity was generated from solar energy. This corresponds to an increase of around 2 % on the previous year. From biomass, around 49.3 bill. kWh electricity were produced. Compared to the previous year, this figure fell by around 5 %. The installed power from wind energy on land and offshore (Fig. 9) increased in 2023 by 3 028 megawatt (MW). For the thermal energy, the share of renewable energies totalled 18.8 % in 2023, in transport only 7.3 %. Particularly in transport, the share has remained well behind expectations.

Electromobility is, however, very popular in Germany. The focus is on reducing dependence on fossil fuels and increasing climate protection. Electric cars have become a central issue in the German automotive and supplier industry. Around 770 000 people are employed in this sector. Measured on sales, the automotive industry is easily the biggest branch of industry in the country. According to the Federal German Statistics Office in 2023, cars and parts alone accounted for 17 % of Germany’s exports. According to expert opinion, for electric cars, Germany is only an also-ran. Falls in sales and recalls here, staff reductions there. The list of negative headlines can be easily continued. The German automotive industry has reached crisis level, for the first time for 30 years, compulsory redundancies and works closures are on the cards. German electric cars have become slow sellers. The production of smaller and more affordable models has been neglected. This is one thing where especially the Chinese manufacturers are one up on German manufacturers.

4 The raw materials industries in Germany

As one of the key industrial nations, Germany is a big consumer of mineral resources. A large part of these mineral resources, especially from the non-metallic mineral industry, are extracted in domestic deposits and quarries. The current BBS Resources Study 2022 [3] assumes an extraction of non-energetic mineral primary resources of 591 Mta in 2019 after 726 Mta in 2000. The figures for important primary resources for 2019 with an estimate for 2040 are shown in Fig. 10. According to this, in 2040 for a relatively low dynamic of the GDP of average +0.7 %, only 482 Mta primary resources are required. Sand and gravel are falling at a yearly average of -1.1 %, natural stone by -0.9 %, just as limestone for cement production (-0.9 %). The biggest annual losses result for lime and dolomite (-2.3 %), the biggest growth rates are expected for clay, as a result of the increasing production of calcined clays as a substitute for clinker.

While self-sufficiency in the non-metallic minerals industry is secured, covering demand for metallic resources is almost exclusively dependent on the import and recycling of these materials. The few industrial minerals that are extracted along with non-metallic minerals include potassium and magnesium salts, rock salts, industrial soles, whiteware clays, sulphur, quartz, silica as well as fluorspar and baryte. The share of metallic secondary and recycled substances is increasing. In the production of crude steel, secondary materials account for around 46 %, for zinc their share is 18 %, for copper 40 %, for aluminium 58 % and for lead over 80 % (all figures for 2022). For lithium, exploration projects exist. In Germany’s Ore Mountains, Zinnwald Lithium is planning an underground mine with a lifetime of more than 30 years and an extraction rate of 880 000 t/a rock, from which around 180 000 t/a lithium concentrate is to be recovered (Fig. 11). The goal is to produce from this 12 000 t/a lithium hydroxide in battery quality and supply the German and European markets.

The Federal Institute for Geosciences and Natural Resources (BGR) provides in its Commodity TopNews 73 [4] an insight into the extraction and exploration of critical mineral resources in Germany. Metallic ore mining was almost completely discontinued in Germany in 1992, But geopolitical conflicts, increased energy costs and interrupted supply chains have led in past years to significant increases in the price for some raw materials, and therefore in recent years more exploration work for metallic resources has been observed. Especially in the German state of Saxony, companies are currently developing projects for the extraction of metallic resources (Fig. 12). Here, for example, KSL Kupferschiefer Lausitz GmbH, a subsidiary of the international mining holding Minera S.A., is planning to set up and operate a copper mine with a production start in mid-2035. In recent years, more than € 40 mill. has been invested in the exploration and development of the deposit in the Lausitz region on the border to Brandenburg.

Leading resources company for metals in Germany is Aurubis, headquartered in Hamburg, and its global subsidiaries. In the group, at the last count, a total of 1.109 Mta cathode copper were produced from 2.319 Mta bought-in copper concentrate and 0.515 Mta copper scrap and blister material. Aurubis has six copper smelting plants: Hamburg and Lünen in Germany, Pirdop in Bulgaria and three others in Belgium and Spain. All smelting facilities process copper-containing raw materials to copper cathodes of the highest purity. None of the facilities is identical. Pirdop is a purely primary smelter and processes most of the copper concentrate in the group in Aurubis‘ biggest smelting furnace; the Hamburg plant (Fig. 13) uses recycled materials besides concentrates, too. Lünen, on the other hand, specializes in recycling. Other metals like nickel, lead, tin, gold and silver are collected during refining as a starting material for multimetal extraction.

In Germany, potassium and magnesium crude salts are extracted by K+S (Kali und Salz). With its bases in North America and Europe, the group produces around 10 % of the global potash production of 73.5 Mta. K+S operates six potash plants in Germany. The Werra combined plant with the Wintershall, Unterbreizbach and Hattorf locations (Fig. 14) accounts for around 50 % of potash production in Germany. From 2022 to 2031, K+S is investing around € 600 mill. in the Werra 2060 project, which is to safeguard the future at this base. It is all about innovations in extraction and production, lowering energy consumption, reducing CO2 emissions and a changed product portfolio based on changes in the processing and refining processes and reducing the environmental impact, which entails reduction of solid residues from 8 to 7 Mta and avoiding the extension of stockpiling at Wintershall.

In almost every industrial nation of the earth, salt is extracted, in Germany, too. Around 60 % of the global salt production of over 290 Mta come from the conventional extraction of rock salt or from the production of sols. Around 40 % of production is accounted for by seawater and salt lakes. K+S (Kali und Salz) also operates three salt mines at the Braunschweig-Lüneburg, Bernburg and Borth sites (Fig. 15).

As a statistical mean, around 6.6 Mta rock salt, 2.3 Mta evaporated salt and 8.7 Mta sols are produced. That results in 18 Mta salt on average, returning sales of around € 600 mill. The best-known salt brand in Germany “Bad Reichenhaller” stands for high-quality salt from the depths of the alps, carefully recovered from pure Alpine sols. The brining out and storage operation in Ohrensen near Stade is Europe’s biggest solution mine. The operator DOW (Fig. 16) extracts in 11 salt caverns around 3.6 Mta rock salt and uses the sols to extract chlorine, caustic soda and hydrogen by means of electrolysis.

5 Outlook for Germany’s industrial landscape

Recently, it became known that the German government is reckoning with a minus of 0.2 % for the GDP in the current year. Negative economic growth is especially disappointing, especially because slight positive growth had been expected for 2024. Almost all economic research institutes in the country have revised their forecasts downwards. The Munich-based ifo-Institute is expecting stagnation and the Institute for the World Economy (IfW) is assuming a shrinking economic output. Pessimism is the order of the day in Germany, a worsening mood in foreign sales being lamented by numerous associations. The problems in Germany were increasingly of a “structural nature”. In the view of the economic experts, the government’s budget cuts are a burden on the economy while key industries had not reacted to changes at all or only in a very limited way. But such appraisals are not very helpful.

One of the key issues is the skills shortage in Germany. In the skilled trades there is a shortage of 113 000 skilled professionals across Germany according to information from the IW, i.e. that corresponds to vacancies there. That applies especially to automotive technology, building electrics and sanitary, heating and air conditioning systems. This is aggravating the building crisis and the availability of affordable housing. But there are not only shortages in the trades, big deficits are obvious in the care sector, in the IT sector and many other qualified professions. Across Germany 1.7 million vacant jobs require skilled workers. The skills shortage will be aggravated on account of the demographic change and the changes in professions with new fields like digitalization and ecological transformation. Here solutions are called for as without these Germany industry and economy will be facing enormous problems.

Another big issue are the required investments in the future. Germany is not alone here. The recently published “Draghi-Report” [6] shows that Europe is suffering under a significant capital market weakness. While the Americans hold a 70 % of the world share index MSCI World, Germany as the biggest economy in the EU reaches just 2 %. The report calls for an annual amount of € 800 bill. over a relatively long time to make the European economy competitive. For this, huge debts must be incurred, which in a country like Germany nobody really wants to take on. But what are the alternatives. The German economy certainly has to seek more private investment and embrace different models. With regard to political action, the regulatory burden can be scaled back and better general conditions created.

Literature

[1] Burchardt, J. et all: Transformation Paths for Germany as an Industrial Nation – Key points for a new industrial policy agenda, Analysis by BCG and IW commissioned by Bundesverband der Deutschen Industrie (BDI), September 2024, Berlin/Germany

[2] Harder, J.: Economic solutions – Recycling wind turbines, recovery – Recycling Technology Worldwide 04/2024, pp 54-64

[3] BBS: Die Nachfrage nach Primär- und Sekundärrohstoffen der Steine-Erden-Industrie bis 2040 in Deutschland. BBS Bundesverband Baustoffe – Steine und Erden e.v. Berlin/Deutschland

[4] Henning, S. et all: Kritische mineralische Rohstoffe in Deutschland – Gewinnung und Exploration. Commodity TopNews | 73. August 2024, B1.2 Geologie der mineralischen Rohstoffe, Bundesanstalt für Geowissenschaften und Rohstoffe (BGR), Hannover/Deutschland

[5] Kopp, J. et all: Precius metals and selenides mineralisation in the copper-silver deposit Spremberg-Graustein. December 2012, Zeitschrift der Deutschen Gesellschaft für Geowissenschaften 163 (4), pp 361-384

[6] Draghi, M.: The future of European competitiveness – In-depth analysis and recommendations. EU-Government, 9.Sep. 2024, Brussels/Belgium

Author

Dr.-Ing. Joachim Harder, OneStone Consulting Ltd., Varna/Bulgaria

![8 Competitiveness of the industry [1]](https://www.at-minerals.com/imgs/2/1/8/0/1/1/4/tok_60bd9b320d16461f0a43aab2f395faf4/w300_h200_x600_y388_08_Bild8_BCG-IW_Transformation_Paths_L-62bba7e5a8b3a4c4.jpeg)

![10 Mineral primary resources [3]](https://www.at-minerals.com/imgs/2/1/8/0/1/1/4/tok_0a9195b445806b6d302662b5b6d1fa64/w300_h200_x421_y297_10_Harder_Primaerrohstoffe-871321a18d893a7b.jpeg)

![12 Copper project in the Niederlausitz region [5]](https://www.at-minerals.com/imgs/2/1/8/0/1/1/4/tok_7b541fcf7efe51db894e5242ab02af6b/w300_h200_x600_y417_Bild12L_The-Zechstein-base-at-the-copper-silver-deposit-7d8a5a9a583dda33.jpeg)