Development of digitalization and AI in the raw materials sector

Summary: The digitalization of the mining industry promises huge potential for improved economic efficiency, resource savings and greater safety. If digitalization can be successfully combined with artificial intelligence (AI) methods, completely new possibilities will be open to certain applications. In the following article, the author shows what is understood by Mining 4.0 today and what is already feasible.

1 Introduction

Every minute, Rio Tinto, the globally successful mining company, captures and transfers around 2.4 terabytes of digital data from mobile equipment at its mines and operations [1]. That corresponds roughly to 2 400 times the content of the Encyclopaedia Britannica. Can this volume of data be integrated in a system that is remote-controlled by operators? Rio Tinto has shown that this is already possible to an extent. The road to full deployment in all mining operations is, however, still long, as is the automation of all processes. An interesting approach is the linking of process data to artificial intelligence (AI) and machine learning (ML), and the use of computer systems that automatically identify patterns and use specific learning algorithms. At present, the requirements for such systems still differ from company to company.

2 Requirements

Almost all over the world, the mining industry is faced with growing challenges, higher costs for exploration, poorer ore quality, rising costs and, in some cases, decreasing revenues [1]. Digitalization of the mines and processing operations and increasing automation could provide one remedy. Sought are solutions for improved efficiency, lower emissions, lower resource consumption, improved work safety, friendlier working conditions, and naturally cost savings. This is largely the same for all companies. Different, however, are the goals for digitalization and AI and what status has already been achieved, or what road still has to be travelled. The following list shows how far leading mining companies are currently moving ahead, whereas a large number of companies tend to be still at the beginning:

Intelligent mine: Goal is the maximization of the use of real-time data for optimum extraction and processing of ore based on the use of geological databases and new exploration processes.

Autonomous fleet: Here it is about improving efficiency, work safety and accuracy, with infrastructural improvements, new control technologies and applications, artificial intelligence, like, for example, autonomous mining machines and vehicles.

Optimized process control: Use of technologies that standardize and improve operation and control of production plants to increase productivity and process safety as well as to improve reliability by means of predictive condition monitoring of equipment and its maintenance.

Better process control: Goal are improved possibilities for process control based on deviation analyses, statistics, machine learning and conclusions (e.g. predictive analyses, prescriptive analyses, cognitive computing).

Networked employees: Use of mobile systems for more safety and operating efficiency (e.g. safety, time logging, mobile tools that can be used in the field) in collaboration with networked centres for better decision-making.

3 Key technologies

Solutions that range from straight electrification of mining operation to digitalization with automation and AI are offered by a string of suppliers. These include automation suppliers like ABB, Cisco, Emerson, Rockwell Automation, Schneider Electric or Siemens, AI companies like Nvidia Corp. and Trimble, sensor manufacturers such as Hexagon, EPCM (Engineering, Procurement, Construction Management) companies like Bechtel, Fluor, Jacobs Solutions, SKR Consulting, SNC Lavalin or Worley, mobile equipment suppliers like Caterpillar, Hitachi, Komatsu, Liebherr and Volvo, and naturally the wide array of suppliers for the mining sector with the leading companies like FLSmidth and Metso, but also suppliers for specific segments like, for example, Sandvik and Terex for mobile and stationary crushers or, for example, Tomra und Steinert for smart sorting solutions.

No technology enterprise knows all the answers, and therefore only a certain overview of the available technology options is available. A key element in the digital strategy of mining enterprises is therefore cooperation with major suppliers to identify, define and apply the technologies that best fit future requirements. For industrial application in the raw materials sector, the first thing needed is extensive digitalization and processing of the data, the so-called “Internet of Things” or IoT, which is understood as the interconnection of physical objects, i.e. things. Here sensors, devices and systems are connected with each other so that data is exchanged between the objects and, if required, can be used “remote” (Fig. 1). Artificial intelligence (AI) is making increasing inroads into the sector, making many of the existing technologies much simpler, safer, environment friendlier and more sustainable.

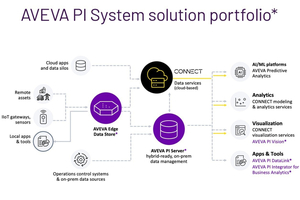

FLSmidth is an example of how future solutions can be realized more easily with partnerships. In 2022, FLSmidth and AVEVA launched a global partnership to accelerate digitalization of the mining sector and push forward with efficient and sustainable applications. AVEVA, which was taken over by Schneider Electric, is by its own account a leading global software company in the sector. The AVEVA PI SystemTM (Fig. 2) is to serve as a central digital platform for all FLSmidth operating processes. Many major mining companies worldwide are using the PI System today to support data-driven decisions and can now harness their existing investments to gain new and wider insights. That increasingly requires a standardization of data capture and processing with the help of the internet and cloud solutions to achieve selective improvements and operative excellence wherever possible.

Other key technologies in digitalization are sensor technologies. In this field, Metso is demonstrating especially how sensor systems can be used to improve and optimize the complete mining and processing operations. More than ten different sensor technologies are available, for both existing and new applications. The Metso Outotec FrothSenseTM takes the optimization of flotation processes to a new level. Other systems like RockSenseTM (2D and 3D) recognize ore transport. MillSenseTM is designed for the optimization of grinding processes. Important digital solutions like SmartStationTM and the automation platform Mineral Crusher Pilot (MCP) (Fig. 3) offer unparalleled insights into the performance and availability of crushers. This enables remote monitoring and performance optimization in real time so that operatives can maximize process productivity and minimize downtimes.

A new key technology is the digital twin, a complete digital representation of a mining operation from the mine to shipping of the products. The technology uses all installed sensors to create virtual simulations of the equipment and infrastructure, for example those of the grinding system, flotation, residue management, water control and the electrical system. Digital twins (Fig. 4) can be used today to simulate changes in the process flows relatively simply and cost saving, without necessitating intervention in the real process. At a copper mine in Peru, Anglo American has proofed that much more is possible with the system, which has so far been considered as not feasible: how can the environmental impact be minimized and how can the data be used to close and decommission the mine later in a controlled process.

Another increasingly important element is satellite-assisted mine exploration. For instance, Rio Tinto has entered into a partnership with the space exploration enterprise Fleet Space Technologies to map the Argentinian lithium project Rincon with the help of artificial intelligence (AI) in 3D. The 3D maps created with the help of satellites and AI (Fig. 5) [2] are intended to represent the subsurface of the reservoir, the depth of the bedrock and the structures influenced by brine on 100 km² of the salt flats of the project and the nearby subvolcanic structures in detail. Digital pictorial maps can be generated up to soil depths of 7000 m. This results in enormous volumes of data which are used for further explorations and exploratory drilling especially at remote locations and reduce the time required and exploration costs considerably. Besides Fleet Space, other providers have entered the market, including NASA.

Autonomous vehicles like dumper trucks and remote-controlled drills are becoming increasingly important in the mining industry. The operators want to monitor and automate their equipment to lower costs, improve productivity and safety and to maximize management and fleet utilization. Suppliers of these systems such as Komatsu (Fig. 6) [3] are working hand in hand with the operators, Results so far show that even large dumper trucks with several thousand tonnes payload can be used autonomously and with an electric drive. Safety can be improved considerably and energy savings up to 15 % are possible. In autonomous drilling rigs underground, it is especially about improving working conditions and working safety. Autonomous and remote-operated crushers can also be more easily adapted to changing ore qualities and tasks.

4 Case studies

4.1 Anglo American’s Quellaveco Copper Mine in Peru

In 2020, Anglo American started up operation at the Quellaveco copper mine in Peru. With the mine, 0.3 million t/a copper concentrate is to be produced over a period of 36 years (Fig. 7). The mine is fully digitalized. The SIMATIC PCS7 process control system from Siemens is used with a SIMIT simulation platform and various migrations to COSMOS PQM, MRO, EI&C and others to visualize, control and intervene in processes [4]. On YouTube there is an around 15-minute video that shows impressively what advances can be achieved nowadays with digitalization, automation, visualization, simulations and forecasts. In the video, different protagonists explain how such mine operations can be optimized while the resources required and environmental impact are minimized at the same time.

4.2 Barrick Gold’s Cortez-Mine in the USA

Mining in the Cortez mountain region (Fig. 8) around 100 km south of Elko in Nevada goes back to the mid-19th century. The Cortez gold mine is owned by Nevada Gold Mines, a JV of Barrick Gold (61.5 %) and Newmont (38.5 %), and is operated by Barrick. In 2024, 1.5 mill. ounces of gold were produced. Barrick and CISCO have been working together since 2016 to use digital technologies to increase the productivity and efficiency of the mines and improve performance and decision-making in all areas of the company. The Cortez gold mine in Nevada was defined as a first project to develop a digital model operation where digital technology is embedded in every dimension of the mine. For example, advanced sensor technology and real-time operating data are used for decision-making. The equipment has been automated to increase productivity while predictive algorithms improve the precision and speed of maintenance and metallurgy. Cortez serves as a model for the digitalization of other mines.

4.3 BHP’s Escondida Copper Mine in Chile

Escondida is the world’s largest copper mine for the production of copper concentrate and anode copper. It is operated by BHP Billiton with a 57.5 % stake, Rio Tinto with 30 % and the Japanese JECO Corp. with 12.5 %. The two surface mines of Escondida (Fig. 9) supply three processing lines as well as two leaching operations (oxide and sulphide). In 2023, BHP and Microsoft began a collaboration to improve efficiency for Escondida with the help of artificial intelligence (AI) and machine learning. The project is aimed at increasing copper production by up to 5 %, which means additional revenue of 1 bill. US$ every year for BHP. The project is also set to reduce running costs by up to 10 % as AI can identify and optimize inefficient processes. The real-time data of the plants are used by the Azure Machine Learning System from Microsoft to enable hourly predictions and give the Escondida operations teams recommendations for optimization of the processes.

4.4 Galore Creek’s Mine in British Colombia in Canada

Galore Creek Mining Corp. (GCMC) is a 50/50 joint venture between Teck Resources and Newmont Corporation. The remote mine in the Tahltan district (Fig. 10) around 370 km north-west of Smithers in British Columbia is so far one of the biggest undeveloped copper-gold-silver deposits in the world [5]. Teck has awarded a contract to the company LlamaZOO for a digital virtual reality simulation of the Galore Creek development area on 1:1 scale, which visualizes the around 30 000 km2 of the project and the surrounding area in breath-taking high definition. With this digital 3D twin, further investigations for exploration of the mine are simpler. Over 60 years and 393 000 m of borehole data that were imported from various software packages can now be used and visualized. With interactive mine exploration, costly trips and exploration on site are no longer necessary, which reduces the health and safety risks associated with such trips.

4.5 Gold Field’s South Deep Mine in South Africa

South Deep gold mine is a model mine in the Witwatersrand basin, 50 km southwest of Johannesburg, South Africa’s commercial capital. The mine lifetime (LoM) of South Deep (Fig. 11) will still last more than 80 years so that the mine will also be important for Gold Fields in the decades to come. For this reason, in South Deep, beginning in 2019 an innovation and technology initiative has been realized for the modernization, integration and optimization of existing processes and systems.

The modernization programme is to help create the mine of the future, integrated upgrades of the robust communications infrastructure and a network backbone enabling remote-controlled and automated workflows and processes. Collision Avoidance Systems (CAS) from Newtrax and environment monitoring systems ensure a safer working environment. Moreover, renewable energies and battery-powered electric vehicles support the goals of a safer, greener and cleaner environment and mine.

4.6 Newmont’s Tanami Gold Mine in Australia

Newmont’s Tanami Expansion 2 (TE2) in the Northern Territory is currently the biggest mine extension project in Australia. The extension of the TE2 processing plant (Fig. 12) will increase the plant capacity from 2.6 to 3.3 mill. t/a [6]. After completion, TE2 will, with 1 460 m, be the deepest production shaft of all mines in Australia. Underground, TE2 was extended by 7287 m towards the sides. The underground material transport system consists of a primary crusher with a capacity of 3.8 Mt/a, belt conveyors and transfer stations. The Minestar Fleet Management System from WesTrac (Caterpillar) introduced in Q2 2024 replaces the existing manual dispatch system with a real-time fleet tracking and data logging. An underground Wi-Fi network tracks now the machine movements and returns precise on the different strata in real time. It supports also a more seamless allocation system and personnel monitoring as well as integrated location communication with live data feeds to the control room.

4.7 PLS’ Pilgangoora Lithium Mine in Australia

PLS (formerly Pilbara Minerals) is a globally leading producer of lithium minerals in the fast-growing sector for battery minerals. With the Pilgangoora Mine, the company owns and operates probably the largest lithium ore mine. The annual nominal capacity in Pilgangoora currently totals 0.68 Mt spodumene concentrate. To exploit the full potential of the mine, with the P1000 project, production capacity is set to increase up to 1 mill. t/a. The first ore can be supplied in Q1 2025. Tomra has various sorting processes [7] and has in addition suppled the world’s largest sorting technology (Fig. 13). The system consists of ten sorters, four TOMRA XRT COM Ter for fine material, 3 XRT COM2.0 for medium-sized material and 3 PRO Primary Color Systems for coarse material. After the commissioning of the plant, 1000 t/h throughput was achieved. It can be used to separate reject material prior to the actual grinding processes, with which energy savings of 8 to 15 GWh are achieved.

4.8 Rio Tinto’s Oyu Tolgoi Mine in Mongolia

Oyu Tolgoi is one of the largest and, with 1300 m, deepest copper and gold deposits in the world (Fig. 14). The safety and ore extraction strategy of the mine is a crucial factor. Rio Tinto can build on the AI Platform (AIP) from Palantir Technologies Inc. As one of the first applications, the “Foundry” system from Palantir is used to generate a digital twin or an ontology system. At Oyu Tolgoi, the system is used for geotechnical risk management. Working with a solid data base and data integration, the engineers can monitor the mine condition at all times and, in line with the production data, manage and optimize the underground extraction. The data-controlled workflows improve the transparency of all processes underground, support accident prevention, provide transparency for optimum cooperation between geotechnics and production engineers and support decisions on the ore extraction workflow and production strategy.

5 Outlook

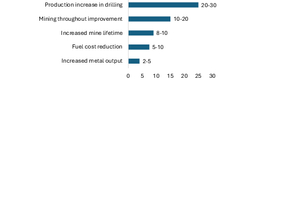

The market for digitalization and AI in the mining sector promises high market potential. According to the market research firm from InsightAce Analytic, the market potential in the mining and raw materials sector is set to grow from 4.6 bill. US$ in 2023 to 20.3 bill. US$ with average annual growth rates of 20.5 %. It is not possible to verify the assumptions. However, the key companies in the sector are correctly represented. A different representation was chosen by the Boston Consulting Group (Fig. 15): its report addresses the typical improvements that can be achieved with AI technologies in the mining sector for selected parameters [8]. The biggest improvements result with 20 to 30 % in the productivity of the drilling operations, followed by 10 to 20 % higher throughput rates in mining and 8 to 10 % longer lifetimes of the mines. For the yields from the processing, 2 to 5 % still appear feasible.

Literatur • Literature:

[1] Marr, B.: How Mining Companies are using AI, Machine Learning and Robots to get ready for the 4th Industrial Revolution. Forbes, Sept. 07, 2018

[2] Australian Space Agency: Centauri-6 satellite exhibit at Discovery Centre. Inspire, 20 August 2024

[3] Komatsu.eu: Komatsu introduces “Smart Quarry Site“. In: AT MINERAL PROCESSING, 10/2023, pp. 28-30

[4] n.n.: Innomotics’ role at Anglo American’s Quellaveco in Peru with digital mining solutions. International Mining, 18. April 2024

[5] n.n.: Driven to deliver critical metals. RoundUp GCMS, January 2025

[6] n.n.: Newmont’s Tanami Expansion momentum building, International Mining, 6 December 2024

[7] Bentham, J.: How AI is powering up sorting in mining. Global Mining Review, 6 February 2024

[8] Kuykendall, T., Keen, K.: Power of AI: AI’s big promises start to deliver for miners adopting new tech. Gás natural, Petróleo, Metais, 19 out. 2023