VDMA Construction Equipment and Building Machinery

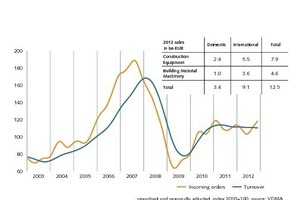

In 2012, German Construction Equipment and Building Material Machinery industry generated 12.5 billion € in turnover. Construction equipment made 7.9 billion € of this sum while 4.6 billion € were made with building material, glass and ceramics machinery. This is a nominal decrease of around one per cent compared to 2011. After having seen an upturn following the 2009 economic and financial crises, the industry is now moving sideways on this decent level it managed to also achieve again in 2012 (Fig.).

“Although, on the whole, times are difficult, last year was a good year for our industry”, says Mr. Johann Sailer, chairman of the industry’s association when reflecting on the results. According to him, 2013 will not see any peaks either. However, companies belonging to the industry have been full of confidence in light of bauma, the industry’s international leading fair, which took place in Munich from 15 to 21 April, 2013. “This event, which takes place every three years, in itself has always inspired new business opportunities. It also is the number one indicator for upcoming market trends”. Taking a look at this year’s figures, though, the first couple of weeks have been rather reluctant so far. The number of orders which came in in the fourth quarter 2012 do not yet indicate any growth either. An increase of demand is most likely to be seen in the second half of the current year, so that the good level of the previous year should also be reached in 2013 once again.

It is very important to watch the situation in China as its development will be of great influence and impact. In 2012, the domestic market on construction machinery saw a decline of 30 %. According to experts at Off-Highway-Research, in 2012, mobile construction machinery worth 100 billion US$ was sold worldwide. Nearly 30 billion of these were sold on the Chinese market alone, nearly 22 billion in North America and only 12 billion in Europe. As with the automotive industry, China has become an important factor for the production and sales of construction machinery. At the moment, the country is facing financing problems and surplus capacities on its domestic market. Experts believe China to have overcome this situation within the next 18 months. In the long-run, this country will be and remain the top market for construction machinery again.

The future looks less bright for the construction equipment and building material machinery industry than in the past. The discrepancy between the markets in North and South Europe keeps getting bigger. It is impossible to predict if and when the construction industries of Spain, Portugal and Greece will finally pick up again. Germany has been and probably will remain stable in this regard. It seems most likely that growth will rather be generated in less traditional markets “which many of us might not really have been considering yet”, is Mr. Sailer’s view. In countries such as Indonesia, Myanmar, some states of Southern Africa or even Mongolia there are lots of raw materials ready to be extracted and those countries’ requirements in improving their infrastructure are enormous.