Raw material situation in North Rhine-Westphalia

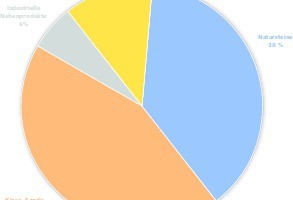

In NRW, vero represents about 152 companies and businesses of the building and raw materials industry. About half of them are sand and gravel plants. The amount of raw materials such companies must produce to meet the demand is constantly rising. In 2017, the production volume of gravel and sand (including quartz) amounted to approx. 56 million tons, with rising tendency (in 2015, the number still amounted to only 53 million tons.) In 2017, the production of natural stones also increased by 3 %.

The orders received in public structural engineering recorded growth rates of 28.6 % (source: Federal Statistical Office, both numbers compared to the period of the previous year 2016). Civil engineering also grew, and the increase in orders received amounted to 13.6 % (source: Federal Statistical Office, both numbers compared to the period of the preceding year 2016). “This trend reflects the development,” says Chief Executive, vero, Raimo Benger. The raw material quantities currently required can barely be covered by the production volume of the businesses. Since many infrastructural measures are scheduled in NRW, it is to be assumed that the demand will further increase,” he explained.

The problem is already visible today, above all with regard to the traffic situation: many road surfaces are in bad conditions. In many places, road and bridge rehabilitation are long overdue, and long-term construction sites on motorways are increasing. The consequence results in long traffic jams.

Increased demand through planned road reconstruction

Due to the high demand, the new NRW state government announced the implementation of numerous reconstruction projects. Already last year, the growth rate for orders received in road construction amounted to 7.7 % (source: Federal Statistical Office, both numbers compared to the period of the preceding year 2016).

As a result, Straßen.NRW records a massive increase in turnover. In 2015, the turnover was still 884 million €, while in 2017 it was already 1.25 billion €. A clear sign that the state is investing in the reconstruction and upgrading of road surfaces. “But: we must also be able to meet the increasing demand for building materials and raw materials arising from it,” says Christian Strunk, President at vero. “Whether or not companies are able to cover the future demand is in the air,” he explains.

Road reconstruction and building projects are at stake

Overall, it is getting more and more difficult for companies of the building and raw materials industry to maintain the extraction of raw materials to meet the demand. This is mainly due to three factors.

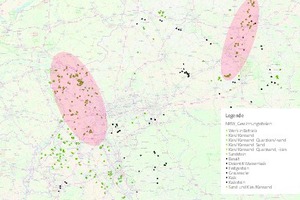

Legal framework conditions and approvals: Maximum mining volumes are often predefined. While raw material deposits are sufficiently available in NRW, areas are sometimes designated that will never be approved. Gaining approvals for extensions is a lengthy process which may take several years. The reasons: there are no regulations for simplified approval processes, decrees require an extended scope of audits and the authorities‘ staff situation causes long processing times.

Strict environmental constraints: Raw material extraction is subject to strict environmental constraints (water protection, soil protection, species protection, environmental protection, immission protection, water protection). In some places, for example, the State Water Act, prevents the extraction of raw materials, even if it is only about an extension (and not about a new development), although there are no hydrogeological concerns. Another obstacle: Such constraints vary considerably in the individual federal states. A uniform regulation of the federal government (of the EU) only exists in the form of a framework legislation. NRW has further tightened this legislation on state level.

Competition for land: Available areas are scarce and compete with agriculture, energy industry and settlement plans.

Import is no solution

With regard to solutions addressing the scarcity of raw materials, industry often faces the suggestion to import lacking raw materials from other countries. “Some companies really do that”, confirms Michael Hüging-Holemans, deputy chairman of the Aggregate section. “The raw materials are then purchased in Denmark, Scotland and Norway. However, this is no solution, since the prices of imported raw materials, such as sand and gravel, are much higher. As a result, with the budgetary resources available, significantly less construction and redevelopment projects can be realized than would be possible if local and decentralized supply was ensured by domestic raw materials,” he states. “This puts the infrastructural planning of the state at risk,” says Hüging-Holemans.

Supply security and responsibility as a message

Raimo Benger, vero Chief Executive, emphasizes: “When realigning regional planning, sufficient supply with domestic raw materials must be taken into account to a greater extent. We call for the quickest possible approval of areas to safeguard the extraction of raw material. This applies in particular to procedures currently stalled.” Moreover, regulations should be unified in terms of environmental constraints, he continued. “These constraints are reasonable, but must be assessed on a case-to-case basis and weighed against each other. Currently, water reserves and Flora-Fauna-Habitat areas (FFH areas) are virtually taboo for raw material recovery. We see urgent need for action in this field,” says Benger and emphasizes: “We always have an eye on environmental and nature protection. Along with our member companies, such as quarries and companies of the sand and gravel industry, we pursue active environmental and species protection. The industry is aware of its responsibility. As a result, it does not only provide raw materials for road and housing construction, but also creates near-natural landscapes that give shelter to rare species.”

//www.vero-baustoffe.de" target="_blank" >www.vero-baustoffe.de:www.vero-baustoffe.de