New strategies in raw material extraction

Summary: The supply of strategic resources can be improved if the natural ecosystems on which the economy depends are not undermined. Mining companies need to develop strategies for a sustainable approach in order to reduce the environmental impact. It is the task and duty of governments to send clear signals and create a long-term political framework. In this article, the basics of resource strategies are explained using a number of selected current examples from different countries around the world.

1 Introduction

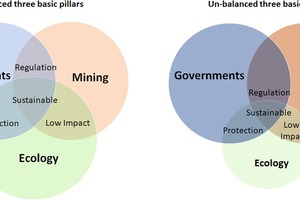

Responsible raw material extraction can succeed if the main players in the triangle of conflicting priorities between politics, mining companies and environmental protection can set and maintain high standards (Fig. 1). If governments jeopardize the ecological and social aspects in favor of economic advantages or one-sided political interests, further disasters threaten, like those already visible in global warming or in epidemics such as COVID-19. Unilateral national initiatives in raw materials policy will tend to exacerbate the problems. What is required are international dialogues and, for example, the establishment of responsible supply chains and partnerships between exploration companies and customers such as metal smelting works and end users in industry.

In Europe and the USA, the scarcity of resources has caused attention to focus on the supply and access to strategic raw materials such as rare earths, lithium and cobalt. These countries are aiming to further underpin their global technological leadership through the expansion of electromobility and digitalization. If the supply of raw materials were to dry up, they would suffer severe economic losses. The situation is similar in the case of China. However, China is extremely active in building partnerships with raw material suppliers. The raw material supplier countries, on the other hand, are about to sell out their important mineral resources. The different perspectives are illustrated using Australia, Brazil, Russia and South Africa as examples of raw material countries, and China, the USA and Germany as examples of raw material importing countries.

2 Typical raw material countries

Common to all the countries portrayed here is their individual local structure for the refinement of raw materials, but that overall, their economies depend to a large extent on raw material exports. When mineral commodities are mentioned here and in the following sections, metallic mineral raw materials and coal are meant and not non-metallic raw materials (industrial minerals, phosphates).

2.1 Australia

Australia is one of the most resource-rich countries in the world and plays a leading role as a raw material supplier on the world market. The country’s main products include iron ore (Fig. 2) and coal. Bauxite, uranium, copper, nickel, zinc, gold and manganese are also important mining products. The low-volume raw material products include the heavy mineral sands ilmenite, rutile and zirconium as well as lithium. In addition to the large deposits of raw materials, Australia’s proximity to the sales markets in Asia and especially to China will ensure that its mining industry will enjoy continued significance in the coming years – with correspondingly favorable prospects for the economy as a whole. However, the recent decrease in demand from China led to a drop in prices for raw materials and slowed Australia’s economic growth [1].

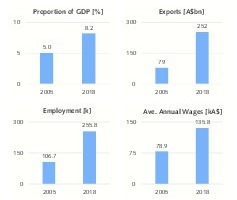

Nonetheless, Australia’s resources sector provides the country with economic prosperity, jobs, high wages, investment and tax revenues. Since the mining boom in the mid-2000s, the key market data have shot up (Fig. 3). According to current figures from the Minerals Council, of Australia, the resources sector together with mining services currently account for around 8.7 % of Australia’s gross domestic product. In the last fiscal year, the resources sector generated a record export of A$ 252 billion, which represents more than 70 % of the total value of Australia’s merchandise exports. The number of employees rose from 106 700 to almost 256 000, and the average gross annual wages almost doubled to A$ 136 000 (US$ 95 000). Since 2005, the resources sector in Australia has invested around A$ 720 billion, which is about 40 % of the country’s total investments during this period.

The future outlook is bright. The Australian government, the industry association and the mining companies all assume that the high demand for Australian raw materials will be maintained and that the country holds a technology leadership in the sector, especially when it comes to the successful implementation of new exploration projects. The workforce is well trained and the industry maintains close links with universities such as the University of Queensland, which enjoys a high level of recognition in the mining sector. Up to now, the country has suffered no major environmental disasters. Australia stresses that investments are being made with a view to the future. Western Australia already supplies 50 % of the world’s lithium, which is so important for the production of batteries. In Australia alone, around A$ 10 billion are to be invested in capacity expansions up to 2022/23.

Lithium production in Australia is expected to more than triple by 2025. Greenbushes, the largest mine in the country, has expanded its capacity to almost 2 million t of spodumene concentrate, according to its operator Talison Lithium. Galaxy Resources also owns large reserves of ore. Its operation in Mt. Cattlin (Fig. 4) produces a lithium concentrate (spodumene) product with an ore grading of up to 6.0 % of Li2O, which is exported to the Sichuan Yahua Industrial Group via the Port of Esperance. As of December 31st 2019, Mt. Cattlin held a mineral resource of 14.6 million t at 1.29 % Li2O and an ore reserve of 8.2 million t at 1.29 % Li2O. There is now a total of eight lithium producers in Australia. This also includes Pilbara Minerals, Altura Mining and Core Lithium, all of whom are expanding their capacities. A number of other projects are also in development, such as the Kidman Resources Mt. Holland project, a fact which underlines Australia’s market leadership in the sector.

2.2 Brazil

Like Australia, Brazil is rich in natural resources. The country is the world’s largest producer and exporter of niobium and the second largest exporter of iron ore, bauxite, tantalum and manganese. Other important products are gold, copper, nickel and tin. More than 195 000 people are directly employed in the mining industry. According to the Brazilian association IBRAM (Instituto Brasileiro de Mineração), the sector generated revenues of US$ 34 billion, but this only corresponds to a share of 1.8 % in the country’s GDP of US$ 1868 billion. Raw materials account for 12.5 % of Brazil’s total exports. Iron ore (Fig. 5), with its export quantities of 389.8 million tonnes per year (Mta), accounts for 68 % of Brazilian export earnings. Overall, the mining industry exported raw materials worth US$ 29.96 billion in 2018, compared to US$ 28.38 billion in 2017 and 21.62 billion in 2016 (FOB prices).

Brazil has hit the negative headlines not only because of her ongoing economic problems. In the course of the COVID-19 pandemic, the government’s hesitant actions have turned the country into an epicenter of the disease. The planned opening of the Amazon basin for economic exploitation by the agricultural, energy and mining industries has also met with fierce international criticism. However, in Brazil, the criticism is less pronounced; almost 90 % of the more than 210 million inhabitants live in urban areas and the mining association points out that the mining industry only uses 0.5 % of the total territory of Brazil. It also states that the most important mines and raw material deposits are not located in the Amazon region but in other regions such as Minas Gerais. However, this does not apply to iron ore and copper ore mining.

After the image of the renowned mining company Vale was seriously damaged by two devastating dam breaches, the company is now conducting a review of its existing technologies with a view to replacing them with, for example, FDMS (Fines Dry Magnetic Separation) processes (Fig. 6). In order to improve the standards of the industry, IBRAM committed itself in 2019 to adopt the “Towards Sustainable Mining” (TSM) initiative developed by the Canadian Mining Association (MAC). With the support of MAC, IBRAM is looking for instruments to improve the environmental and social practices in the Brazilian mining industry in areas such as tailings management and also in the financial reports of mining companies. It is anticipated that TSM will help the mining sector to become more transparent, gain more trust among the public, and realize its full potential. The plan is to implement the initiative over the coming five years.

2.3 Russia

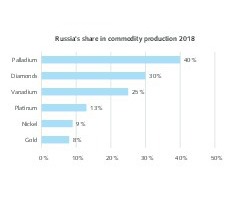

Russia is also among the world’s resource-rich countries [2]. Almost all important mineral commodities are mined: base and precious metals, coal, iron ore, bauxite and diamonds. Fig. 7 shows Russia’s share in the global production output of important raw materials. Particularly in respect of the platinum group metals and diamonds, the country plays a leading role in the global mining industry. Russia is also among the countries with the largest reserves. In order to underpin its policy of using the revenues from exploration and the extraction of raw materials to rehabilitate the national budget, Russia is claiming an area of 1.2 million km2 on the continental shelf of the Arctic Sea. This is all the more important for Russia because its oil and gas revenues are falling due to the present decline in prices. In the wake of the corona pandemic and falling revenues, the Russian government has been forced to suspend implementation of the national development plan originally scheduled for 2024.

For reasons of economy, the mining industry has neglected environmental protection and development of a sustainable environmental policy in many places over recent decades. This also applies to model companies such as MMC Norilsk Nickel, one of the largest Russian raw material companies and world market leader in nickel and palladium as well as other commodities such as platinum, gold, silver, copper, rhodium and cobalt. The company’s Russian production volumes come from the four mines of the Polar Division on the Taimyr Peninsula north of the Arctic Circle and from two mine complexes with open-cast and underground mines on the Kola Peninsula. After a string of damaging environmental issues, the company has recently invested more heavily in environmental protection and sustainable development, which has set an example for other Russian companies.

However, Norilsk’s efforts to improve environmental protection were dampened by two recent oil spills north of the Arctic Circle. At the end of May this year there was a serious accident involving a storage tank for diesel fuel. Possibly as a result of the thawing permafrost, the storage tank collapsed and around 21 000 t of fuel spilled and spread out over two adjacent rivers. Norilsk immediately initiated measures to contain the oil spill and brought in experts from the oil companies Gazprom Neft and Transneft. Among other measures, eighteen retention barriers (Fig. 8) were put in place on the Ambarnaya River and 24 collection tanks were erected for 6000 m3 of contaminated water, while 23 000 t of contaminated soil were removed. Despite Norilsk Nickel’s efforts, another oil spill occurred north of the Arctic Circle on July 12th, when 45 t of aviation fuel leaked from a pipeline.

2.4 South Africa

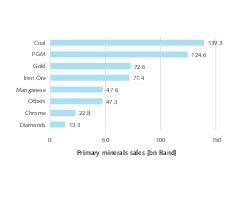

South Africa’s mining industry is an important economic factor, accounting for 8.1 % of the country’s GDP in 2019 after 6.8 % in 2007. In 2019, the country’s mineral commodities generated 538.9 billion Rand (US$ 35.6 billion). Fig. 9 shows how the revenues are divided among the individual raw materials. Coal mining is the leading sector with 139.3 billion Rand and a share of 25.8 % in the total raw material revenues, followed by platinum group metals (PGM) with 23.1 %, where platinum, palladium and rhodium are the main sources of income. The next places in the ranking are taken by gold and iron ore, each with a good 13 % share. The income from diamond mining is now only of minor importance at 2.5 %. Raw material exports amounted to R 348.2 billion in 2019, compared to R 162 billion in 2007. Almost 455 000 people are still directly employed in the mining industry, while government revenues amount to R 8.6 billion from royalties, R 24.3 billion from corporate taxes and R 32.9 billion from VAT.

South Africans are currently worrying about the two most important sectors, coal and platinum group metals. Coal, because it is being phased out as an energy source, not necessarily in South Africa, where 77 % of primary energy is generated from coal, but in respect of exports, which currently account for around 30 % of the coal mining output. The problems with platinum group metals are even more serious (Fig. 10). Although the PGM mining output of 262.2 t is only around 2.9 % less than in 2018, the costs for extraction and the revenue per ton are diverging more and more, so that operating losses have recently been suffered. To prevent an ongoing negative trend, the “National Platinum Strategy” has been launched. This describes various scenarios for how the industry can return to profitability. One way would be to make platinum a currency reserve for the central banks, another would be to boost the development of a hydrogen economy through the use of platinum catalyzers.

3. Typical raw material importing countries

The basic assumptions here differ from country to country, depending on the respective local industries and the available mineral resources. However, it is true for all importing countries that there are a number of critical, strategic raw materials that are either not available or not available in sufficient quantity or quality.

3.1 China

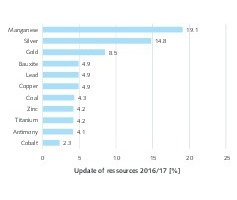

Like no other country in the world, China operates a precise record-keeping system covering all available raw material resources and reserves. The use of new exploration methods, such as satellite surveying, enables constant adaptation of the data for lifetime forecasts for China’s raw material reserves. Fig. 11 shows how the available data for the economically minable reserves of some important mineral commodities have changed from 2016 to 2017 due to the use of state of the art surveying methods [3]. The frontrunners are the reserves for manganese ore and silver with high double-digit increase rates, while the known gold deposits have increased by 8.5 % and the reserves of many other important ores have grown by between 4 and 5 %. It is difficult to assess the extent to which China is able to exploit its current technologies to assist the leading mining companies to achieve high mining outputs. Experts assume that there are still major deficits here.

In order to satisfy its hunger for raw materials, China has been relying on imports for almost 20 years and in the process of time has developed a number of successful strategies. On the one hand, China purchases raw materials such as iron ore, coking coal or valuable metals such as copper, nickel, chromium, manganese, aluminum and platinum, which are available at low prices on the world market. On the other hand, Chinese companies are increasingly acquiring equity shares in mining companies or in strategic projects or purchasing mining concessions themselves. The Chinese mining companies that are now among the global TOP 30 mining enterprises include the energy companies China Shenhua Energy and Shaanxi Coal Industry as well as the more recent TOP 30 members China Molybdenum Co. and Zijin Mining Group Co. who both own Chinese mines as well as operations or shareholdings in operations abroad.

China Molybdenum was only founded in 2006 and operates mines for molybdenum, tungsten, copper, cobalt, niobium and phosphorus minerals and is among the world’s leading companies for most of these. In addition to its operations in China, the company has made investments in operations or joint ventures abroad, mainly in Brazil, Australia and the Democratic Republic of the Congo (DRC), where it acquired 56 % of the shares in the Tenge Fungurume copper/cobalt mine (Fig. 12) from Freeport-McMoRan in 2016. Zijin Mining is mainly engaged in the mining of gold, copper and zinc and has grown into an international mining company through equity participations. In Papua New Guinea, Zijin has taken over 50 % of Barrick Gold’s 95 % stake in the Porgera gold mine (Fig. 13). In a further 10 countries outside of China, including the DRC, Serbia and Colombia, the company is active in mining investment projects. In addition to these examples, Chinese mining companies are now involved in numerous other projects, as well as mergers and acquisitions, abroad.

3.2 USA

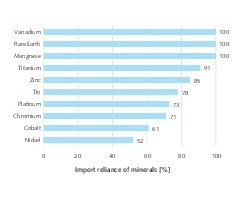

Although the USA possesses a large number of mineral resources, the country is dependent on imports for important mineral commodities. Fig. 14 shows the USA import percentage of selected strategic raw materials for 2018. For more than 10 % of mineral commodities such as vanadium, manganese, rare earths but also niobium, tantalum and indium, the USA is 100 % dependent on imports. For more than 20 other raw materials, the country’s dependence is very high. In 2019, the USA therefore launched an initiative to ensure secure and reliable supplies of strategic raw materials needed for electromobility in order to end its dependence on China. Numerous raw material supplier countries, such as Australia, Botswana, Peru, Brazil, the DRC, Namibia, Zambia and the Philippines, have meanwhile joined the initiative. One objective of the initiative is to share with partner countries the USA’s expertise in the exploration and exploitation of mineral deposits, including lithium, copper and cobalt.

There are numerous other projects in the USA that aim to identify critical raw material deposits that have not yet been discovered. A project that is being promoted by the US Institute for Geological Surveys (USGS) with the title EarthMRI (USGS Earth Mapping Resources Initiative) has the objective of exploring such deposits in the inaccessible area of Alaska (Fig. 15). This includes the investigation of new ways of exploring mineral resources from the air and making them ready for practical use. Research is also being carried out into new mining methods. For instance, the process now known as the Frasch process, which has hitherto been used for extracting sulfur deposits, involves the injection of hot water into the soil in order to dissolve certain components, which are then conveyed to the surface with the help of compressed air.

3.3 Germany

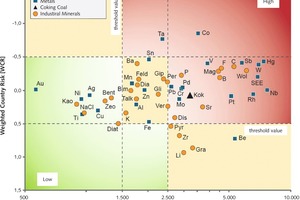

The Federal Republic of Germany is one of the world’s largest consumers of mineral commodities. While domestic deposits are available for non-metallic raw materials, such as potash and salt, or pit & quarry minerals, Germany is almost 100 % dependent on imports for metallic mineral commodities. In March 2020, the federal government adopted a new raw materials strategy, which essentially continues the earlier raw materials strategy dated 2010. While the previous strategy was largely influenced by price and procurement problems for critical raw materials, the new strategy more strongly addresses the problems incurred through changes in demand, disruptive technologies, trade disputes, responsible raw material extraction, socially and environmentally friendly supply chains and other sustainability issues [4]. The number of raw materials regarded as critical has increased accordingly (Fig. 16).

The recycling of important non-ferrous metals is therefore becoming increasingly important in Germany. One example reflecting this fact is Aurubis AG, based in Hamburg (Fig. 17) and several other locations in Europe and the USA, which has become a leading global supplier of non-ferrous metals and the largest copper recycler in the world. The company processes complex metal concentrates, scrap metals and metal-containing recycling materials into metals of the highest quality. Aurubis produces more than 1 million t of copper cathodes annually and uses them to manufacture various products made of copper or copper alloys. Moreover, Aurubis produces many other metals such as precious metals, selenium, lead, nickel, tin and zinc. However, as the amounts obtained by recycling are not yet sufficient to meet demand, the company continues to rely on primary raw materials such as copper concentrate and, for example, recently concluded a long-term supply contract with Teck in Chile.

4 Outlook on the mining companies

Mining companies have a key role to play in the development and use of new strategies for extracting raw materials. The focus is on such “smart” practices and technologies that serve to increase yields, save energy, improve profitability and environmental compatibility and produce market-oriented products for customers. This already takes place during the resource exploration stage through the use of new surveying and planning processes. Improvements are also being made with regard to productivity and autonomous processes in ore mining, higher processing throughputs achieved through progressive process control, improved logistics and finally price maximization by manufacturing market-oriented and market-specific products.

Literatur • Literature

[1] Harder, J.: New Realities – Australia’s mining industry in the doldrums. AT MINERAL PROCESSING, 6/2015, pp. 62-72

[2] Harder, J.: Current market developments – Russia’s mining industry on an upswing. . AT MINERAL PROCESSING, 3/2020, pp. 40 – 53

[3] Ministry of Natural Resources, PRC: China Mineral Resources 2018. Geological Publishing House, Beijing/China 2019

[4] Damm, S.: DERA Criticality Assessment 2019. Presentation at EU Raw Materials Week 2019 – 3rd EU Critical Raw Materials Event, Brussels/Belgium, 18 – 22 Nov 2019

Author:

Dr.-Ing. Joachim Harder, OneStone Consulting Ltd., Varna/Bulgaria

www.onestone.consulting

Joachim Harder (1952) studied process engineering at Braunschweig University of Technology and earned his Ph.D. there. After more than 10 years working in industry in various management posts, in 1997 he established the consulting company OneStone Consulting. Dr. Harder is an acknowledged expert in international marketing, specializing in market analysis for business segment strategies. He is the author of diverse publications and a popular conference speaker.