Manufacturers of building material plants are optimistic: Sales increase expected for 2017

Despite all heterogeneity, German manufacturers of building material plants are expecting a broadly based boost this year. Even at the end of 2016 the orders received in most subsectors had risen considerably compared with the previous year. “This should translate into sales growth over the next few months,” says Sebastian Popp, economic expert on construction equipment and building material machinery on the occasion of the Building Material Plants Day, held by the German Engineering Federation (VDMA) in Frankfurt as an exclusive event for its member companies on 26 and 27 April.

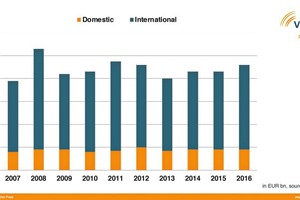

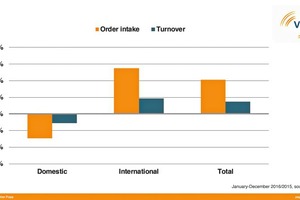

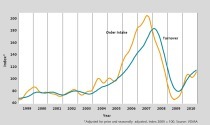

In 2016, after several years of decline without any real impetus, German manufacturers of building material plants recorded an 8 % rise in sector sales compared with the previous year, totalling € 4.7 billion. The increase came above all from international business. At the same time, there was a rise in new orders of about 20 %. These, too, largely came from international customers. The United States continues to be the biggest sales market for building material machines from Germany, followed by China and Russia. This good situation, however, does not indicate any substantial boom. It is mainly due to several large-scale orders that have mathematically boosted the industry as a whole.

Nevertheless, the industry is optimistic about 2017. Europe’s construction industry should develop robustly, growing by an estimated 2 %, with Germany and the UK as the greatest stimulants. Good market opportunities are also discernible in the United States and in some emerging economies, such as India and Indonesia. According to IA Cement, global demand for cement will go up 2 % this year, and Citi Research reports that, after a long spell of barrenness, mining companies are interested in making purchases again throughout the world.

Views from the subsectors

In 2016 companies making concrete technology recorded a good development of the German market coupled with a sharp decline in orders from other countries. Many companies suffer particularly from the sudden slump in their Russian business, which continues to be difficult to compensate for. “In 2016 we more or less lived on the money we’d earned in 2015,” says Hermann Weckenmann, Chairman of the Concrete Technology Section of the VDMA. This will continue to be a concern for companies in 2017. During the first 4 months of the year, however, the order situation apparently improved, giving rise to hope for the rest of the year. Business is picking up again, especially in Europe, but particularly in Germany, and also in the United States. Moreover, things seem to be getting off the ground again in Russia. Further positive signals, are coming above all from Southeast Asia. In all, however, the industry has no confidence in any medium or long-term stable, positive development. The general global framework is not what it should be. Developments and business are apparently far less predictable or plannable than they were a few years ago. Manufacturers are also rather concerned about the current trend for nation states to withdraw to their own spheres, raising the spectre of new trade barriers and sealed-off markets. It is felt that the market potential for concrete technology is considerable, although not many are willing to invest. In Germany, in particular, there is no reward for investments. The general impression in the group is that “the mood here doesn’t exactly inspire much joy”.

After fairly weak sales in 2016 manufacturers of mineral processing systems and of cement, lime, gypsum and dry mortar plants believe that business in 2017 will be better than in the year before. By 2018 there should be a vigorous revival again which will impact both subsectors. The delegates emphasised the heterogeneous nature of the markets, as there is no longer a boom region or even a boom country, which there used to be in the past. Europe, excluding Russia, continues to be seen as a robust region, particularly for gypsum and cement. The companies are mostly pleased with market developments in Southeast Asia and India, countries where they believe growth is likely for coal and cement, in particular. The same applies to Brazil and – for cement – also Northern Africa and the Arabian peninsula.

The Building Material Plants Day, held once a year, is aimed at companies supplying building material systems to the cement, lime, gypsum, dry mortar, glass and ceramics industries. It also functions as a meeting point for the industry, an information event and an opportunity to exchange experiences. Topics range from marketing through research to technical areas and are as diverse as the industry itself. The next event will be held on 7 and 8 March 2018.

$(LEhttp://