Appetite for commodities

What will become of China?Summary: In recent years China was the driving force for the global mining industry and triggered a boom in mineral commodities markets. One important indicator is the steel industry and the associated demand for iron ore, metallurgical coal, manganese ore, copper, nickel, chromium, zinc etc., where demand from China sometimes accounts for far more than 50 % of worldwide trade. However, the prospects are looking increasingly gloomy. Analysts are unanimous in forecasting that China is facing a significant decline in economic growth. Some sources are even talking of a crash landing. This report deals with the situation in China‘s mining industry, taking iron ore, coal and gold mining as examples. Trends are discussed and prospects are presented.

1 Introduction

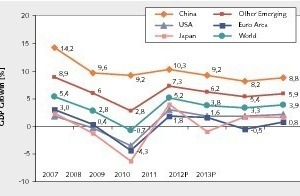

In March, the Chinese government reduced its growth forecast for the current year to 7.5 %. This is the lowest figure in the last 10 years. This year China is confronted by a difficult situation. The prospects for her export industries have declined enormously due to the European debt crisis and the long-term weakness of the US economy. Last year, the world‘s second biggest national economy still showed a growth rate of 9.2 %. By comparison (Fig. 1), the world economy rose by 3.8 %, the economies of the other up-and-coming countries by 6.2 % and the economy of the EC countries only grew by 1.6 %. The current IMF forecast published in January anticipates that China will show a growth of 8.2 % in 2012 and 8.8 % in 2013. Its growth forecast for the world economy is 3.9 % in 2013, while EC countries will only achieve 0.8 % after -0.5 % in this year. Up to 2030, the organization Global Insight reckons that China‘s economic growth will decline to 6 %.

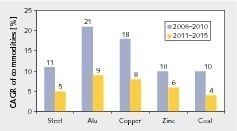

Fig. 2 depicts the growth in China‘s demand for mineral commodities for two 5-year periods. From 2006 to 2010 the average annual growth rates e.g. for steel, zinc and coal were at 10 or 11 %, the rate for aluminium was 21 % and for copper it was 18 %. The forecasts published by Credit Suisse, who regularly report on the commodities market in China in their Economics Research, are significantly more negative. They anticipate that the country‘s annual growth in demand will slump by around 50 % from 2011 to 2015. Steel consumption will only grow by 5 % and aluminium consumption only by an average of 9 %. However, other analysts put a far larger margin of error in their forecasts because of the uncertainty surrounding the world economic situation. For instance: according to BHP Billiton China‘s per capita steel consumption, which is currently at around 457 kg, could rise to 555-830 kg by 2025.

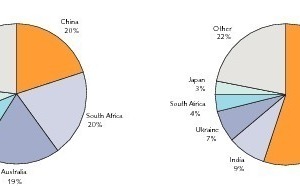

China has become a gross importer of many mineral commodities. It should be noted, however, that many of China‘s own ores have mineral contents below the standard of ores from countries such as Australia, South Africa, Brazil or Canada. For this reason, China generally first mines the ores that are worth mining and then imports a large portion of the still needed mineral commodities although resources are available in the country. Fig. 3 shows the imbalance between ore production and consumption by the example of manganese ore. In the production of 20 % “low-grade” ores, China is one of the leading countries, alongside the “high-grade” producers South Africa and Australia, but the Chinese production output only covers a fraction of her consumption, which was 55 % of global consumption in 2010. Compared to China, the other countries‘ share in global consumption figures are far smaller. The steel-producing countries India and Ukraine are at 9 % and 7 %, the economic powerhouse Japan is at 3 % and the USA is not even in the TOP 5.

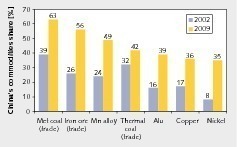

The Chinese share in the consumption of important mineral commodities has increased dramatically in recent years (Fig. 4). In the case of coking coal (metallurgical coal), China already had a share of 63 % of global trading in 2009, while in the case of iron ore her share was 56 %. Fig. 4 impressively illustrates how China‘s hunger for mineral commodities has grown. Her share in the consumption of nickel was only 8 % in 2002, but had grown to 35 % by 2009. The great increases can be partially explained by the fact that in 2009 China was still practically unaffected by the global economic crisis, whereas most other countries were already in dire straits. The question now is what rate of growth can China achieve in coming years, and has it been worthwhile for many mining companies to invest so much money in mining capacity expansion on the assumption that they would export larger and larger quantities to satisfy China‘s growing appetite for mineral commodities.

2 Important mineral commodities

The following section concerns three sectors of the Chinese mining industry – the iron ore industry, the coal industry and gold mining. Gold mining has advanced to become China‘s new most important sector of the economy and since 2007 the country has pushed South Africa out of the top ranking.

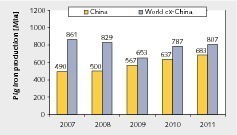

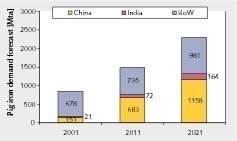

Within a period of just a few years, China has become the world‘s biggest producer of pig iron. In 2011, the country produced 683 million tonnes (Mta) of pig iron, which amounts to 45.8 % of the global production figure (Fig. 5). It is particularly significant that in 2009, when worldwide pig iron production slumped, China achieved a growth of 13.4 %. In 2011 the country‘s growth rate was still 7.2 %. According to a forecast of the World Steel Association, China‘s pig iron production will grow by an annual average of 5.4 % to 1158 Mta by 2021 (Fig. 6). India will achieve the biggest increase of 8.6 %. Of the delta of 246 Mta from 2011 to 2021 for the rest of the world (RoW), the developed countries will total only 69 Mta, while the up-and-coming countries will achieve 177 Mta. Accordingly, at least in the steel industry China‘s prospects are positive. Nevertheless, leading suppliers of iron ore, like BHP Billiton, Vale and Rio Tinto (Fig. 7) anticipate that their supply quantities will continue to fall.

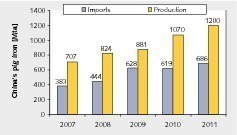

Fig. 8 shows China‘s iron ore production and imports. It shows how imports rose strongly in recent years from 383 Mta to 686 Mta, but also that domestic production rose even more strongly in absolute figures from 707 Mta to 1200 Mta. In the second half of 2009, domestic production overtook imports for the first time. Analysts at Mysteel reckon that China will produce approx. 1600 Mta of iron ore in 2015. The estimated import figure for 2015 is 720 Mta, which indicates that imports will show an absolute increase of only 34 Mta in the coming years. When considering this situation it must be taken into account that Chinese companies are actively acquiring mining rights in foreign countries, which will inevitably reduce import purchases from other companies. One of the following paragraphs deals with Chinese investments abroad.

China’s steel industry is still highly fragmented. The TOP 10 steel producers currently account for 45 % of production output. Among the largest companies are Hebei Iron & Steel, Baosteel, Wuhan Iron & Steel, Anben Iron & Steel, Jiangsu Shagang, Shandong Iron & Steel, Shougang, Hebei Xinwuan Iron & Steel, Maanshan Iron & Steel and Hunan Valin Steel. Due to the rise in mineral commodities prices, these companies have focused more strongly on mining their own iron ore. The biggest steel producer, Hebei Iron & Steel, intend to increase its self-sufficiency in iron ore from the present 9 % to 40 % by 2015. In July 2011, it put the Yanshan concentration plant into operation with a capacity of 15 Mta. Now, a 15 Mta plant in Tianxing, a 5 Mta plant in Dajiazhuang and a 25 Mta plant in Macheng are to follow. Taiyuan Steel, a manufacturer of stainless steel in China, plans to increase its self-sufficiency to 60 % by 2015 and is investing, for instance, in the 22 Mta Yuanjiacun Mine and concentration plant.

The domestic Chinese iron ore production is substantially concentrated in 5 provinces in the north of the country: Hebei, Inner Mongolia, Xinjiang, Jilin and Gansu. Hebei and Inner Mongolia account for almost 80 % of production output. Most of the mines are extracting magnetite and the relatively low iron content of the deposits, amounting to 19 % on average, can be expected to further decline in the future. Because of the high domestic demand, a wave of mine takeovers is currently taking place. Wherever feasible, the new owners take steps to increase the production capacity. Iron ore trading firms such as China Minmetals and Sinosteel are also expanding their activities. Minmetals owns iron ore resources amounting to more than 600 Mta in China. Sino-steel is one of the few Chinese companies on this sector that are already active outside China. In 2008, Sinosteel took over the Channar Mine in Australia (Fig. 9) from MidWest. This mine produces 200 Mta and up to now has exported about 11 Mta annually to China.

One of the biggest foreign projects undertaken by Chinese companies so far is the Sino Iron Project of Citic Pacific Mining near to Cape Preston in the Pilbara Region of Western Australia. This is expected to have an annual yield of 24 Mta of iron ore and the useful life of the mine (Fig. 10) should be at least 25 years. Construction of the iron ore concentration plant (lead picture) is already well advanced, so that commissioning should take place in the near future. The infrastructure for the project comprises a 450 MW gas power station, a water desalination system and a loading terminal near Cape Preston. Other Chinese investors abroad are Chongqing Iron & Steel with the Extension Hill project in Australia, Wuhan Iron & Steel (WISCO) with a mining project in Madagascar and Prosperity Minerals, who plan to take an equity interest in the Malayan company All Wealthy Capital. In addition, Baosteel is interested in participating in a joint venture to carry out the Simandou iron ore project in Guinea.

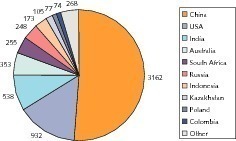

China‘s share of the global hard coal mining output is 51 % (Fig. 11). In 2010, the country produced 3162 Mta of hard coal while the worldwide production was 6185 Mta. The total coal consumption of China was 3.7 billion tonnes in 2011, of which 3.53 billion tonnes were mined by the domestic industry and 170 million tonnes were imported. The imports mainly involved coking coal, which is used by the steel industry. Only 30 % was power station coal. According to a forecast by the China Electricity Council, China‘s coal consumption will rise to 4.3 billion tonnes by 2015, which is an increase of 970 million tonnes over 2010 and corresponds to an average annual growth in consumption volume of 5.2 %. In comparison with the tonnage mined by other leading nations like the USA and India the significance of this growth becomes clear.

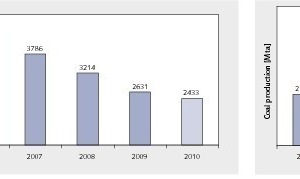

China‘s booming coal production does, however, have a negative aspect which should not go unmentioned - the human suffering that it entails. In many mining operations the safety standards are far below international requirements. For this reason, there is still a high death toll every year due to mining accidents. Although Chinese statistics (Fig. 12) show that the number of fatal accidents has decreased rapidly, there were still more than 2400 fatalities in 2010. Chinese authorities argue that against the backdrop of the substantial increase in mining output the decrease in fatal accidents shows that the closure of unsafe mines has already made considerable progress. On the other hand, there is the impression left by TV pictures of uncontrollable coal mine fires in China. These are said to be responsible for 2-3 % of global carbon dioxide emission.

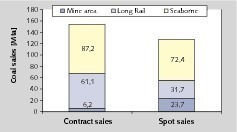

In China coal is mined by the open pit method as well as in underground mines. At present, the country is said to have around 17-18 000 mines in operation. Like the steel industry, the coal industry is also highly fragmented, even though concentration processes are clearly taking place on the mining sector and through the closure of smaller and unsafe operations. The TOP 3 mining operations China Shenhua, China Coal and Yanzhou Coal account for about 25 % of China‘s coal production. China Shenhua, the largest company, sold 292.6 Mta of coal in 2010 alone (Fig. 13) and has meanwhile achieved a market value greater than that of the US coal giant Peabody Energy. Fig. 14 shows a breakdown of China Shenhua‘s domestic sales in 2010. Beside the company‘s domestic sales of 282.3 Mta, only 10.3 Mta were exported. Around 55 % of the sales involve long-term contracts, with the most important five customers accounting for 12.8 %. 45 % are sold on the spot market.

57 % of the coal destined for the domestic market is transported by ship. Shenhua primarily makes use of Huanhua Port (Fig. 15) and the Shenhua Tianjin Coal Dock which handles 65 % of the company‘s marine transportation. Approx. 11 % of the mined coal is sold to customers located in the vicinity of the mines, while 33 % is transported by railway and sold further away. In 2010, China Shenhua additionally purchased from other mines a quantity of 72.4 Mta, or 25 % of its coal sales. In the first 9 months of 2011, China Shenhua increased its coal sales by 26.7 % over the preceding year. Place 2 in the ranking is taken by China Energy Coal (formerly China National Coal). This company owns 21 mining operations in 8 coal mining regions in the provinces of Shanxi, Jiangsu, Heilongjiang and Shaanxi. In 2010 it produced 122.5 Mta of coal, of which 103.9 Mta came from the Pinshuo Mining Region alone (Fig. 16), about 50 % from open pit mines and 50 % from underground mines. Yanzhou Coal Mining is in third place in the ranking, mining the two large coal deposits near Yangzhou and Jinig East and achieving around the same production output as China Coal.

These foremost companies are actively engaged in acquiring resources in foreign countries. Yanzhou, for example, already owns the Austar Coal Mine, Tianchi Coal Mine and Zhalou Coal Mine in Australia, where it currently produces around 5.2 Mta of coal for export to China. The firm recently took over Gloucester Coal for 2.2 billion Australian dollars. In Mongolia, China Shenhua recently secured access to one of the largest coking coal deposits in the world. The company acquired a 40 % share in the western Tsankhi Block of the Tavan Tolgai raw materials deposit. The remaining shares are held by the Mongolian state.

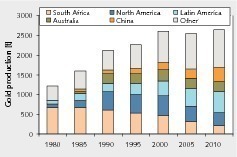

According to a market report of the renowned GFMS, China‘s Gold consumption on the jewelry sector rose to 452 t in 2010, after 215 t in 2000. In the same period of time the demand for gold bars rose from 10 t to 179 t. According to the China Gold Association, gold consumption rose to a total of 761 t or 24.47 million oz in 2011. Fig. 17 shows the development of gold production in the most important countries over the last 30 years. Since 2007, China has been the biggest producer, ranking before South Africa. In 2010, the country mined 341 t of gold after only 10 t in 1980 and 130 t in 1995. In 2011, China‘s production rate grew to 361 t, which corresponds to an annual increase of 5.9 %. However, a comparison with the consumption figures shows that substantial imports are still necessary. In 2010, the import figure was 245 t, followed by a leap in 2011 to around 420 t, which is substantially higher than the domestic production volume.

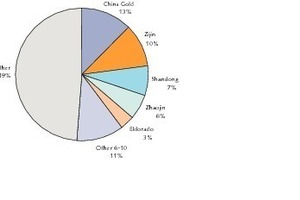

The five provinces in China with the highest gold production rates are Shandong, Henan, Jiangxi, Fujian and Inner Mongolia. In 2011, these produced 59.9 % of the country‘s total output. Other provinces with significant mining outputs are Hunan, Shaanxi, Guizhou, Xinjiang, Gansu and Liaoning. There are numerous small mines, some of which are referred to as “backyard” operations. Even for international players the sector is difficult to assess because of lack of data, and therefore only a few international companies such as Eldorado, Silvercorp Metals and Inter-Citic Metals have so far gained a foothold on the Chinese market. Leading global companies like Barrick Gold, Goldcorp, Newmont, Newcrest Mining and AngloGold Ashanti are not yet represented on the Chinese market or have not yet been granted mining rights. For this reason, the TOP 10 companies, who accounted for 51 % of the mining output in 2011 (Fig. 18), are almost exclusively Chinese firms.

Among the TOP gold mining companies in China are the China National Gold Group Corporation, ZiJin Mining Co., the Shandong Gold Group, Zhaojin Mining and Eldorado Gold. The market leader is China National Gold (CNG) with a market share of approx. 13 % due to a production quantity of 43 t in 2010. About 10 % of CNG‘s gold production will in future come from Jinshan Gold Mines, where a three-stage crushing plant was recently installed (Fig. 19). The ZiJin Mining Group is in second place in the rankings with a market share of 10 % due to its output of 35.5 t in 2010. In China, the company owns several gold mines working reserves in excess of 750 t. It is also engaged in projects in Australia (Norton Gold Fields), Mongolia and the Dem. Rep. of Congo. In addition, the company mines copper, zinc and iron ore. Also among the top five companies are Shandong Gold, who operate six gold mines in China and have an equity interest in Mongolia, as well as Zhaojin Ming and Eldorado Gold (Fig. 20).

The leading gold mining companies in China have made substantial profits in recent years and most have reinvested in the form of plant and equipment modernization, increased shareholdings in other enterprises and further acquisitions. For example, Zhaojin, the number 4 in the rankings, invested the sum of 739 billion RMB for the purchase of additional mines in 2011. This involved a total of 8 mining projects in the provinces Xinjiang, Gansu and Shandong. In the last-named province, the company purchased the Daqinjia, Ji Shan and Zaoyangshan gold mines. Zhaojin also allotted 195 billion RMB in geological exploration, concluding numerous framework contracts with provincial governments and regional administrations. The company now owns 37 exploration licences covering an area of 1315 km2 as well as 35 mining licences covering an area of 74.6 km2.

3 Prospects

China‘s mining industry has profited more strongly from the country‘s mighty hunger for mineral commodities than have the international competitors. For one thing, the increases in domestic production quantities are higher that the import volume, as can be seen by the example of iron ore mining. And another factor is that Chinese companies have made use of their profits to purchase mines and resources in foreign countries. At the same time, international mining companies have so far achieved little penetration of the Chinese mining industry. If the Chinese demand for commodities is inevitably reduced in coming years due to a lower economic growth, imports will probably suffer the most. Only with regard to those ores whose mineral contents are far lower than international standards, is Chinese domestic production in danger of becoming uneconomical and uncompetitive.