Opportunities

Overview of the mining industry in MexicoSummary: Mexico is currently being regarded as the Eldorado of the global mining industry. The country has, for a long time, been the leader on the silver production sector. However, the revenue from gold production has meanwhile taken over as Mexico‘s biggest source of income. On both the gold and silver sectors, Canadian companies now have the greatest market power in Mexico. These and other developments, as well as the most important mining companies in Mexico are presented in the following report.

1 Introduction

Mexico is the world leading silver producer and is among the TOP 15 countries for 20 other minerals, such as gold, copper, zinc, lead, manganese, molybdenum and iron ore. The country is richly blessed with mineral resources (Fig. 1). According to international criteria, Mexico has 6 very large and 23 large deposits of ore. Silver, gold, copper and zinc are mainly mined in the north of the country and in the mid-west region. By contrast, the oil reserves are mainly located in the east and south of the country. More than 80 % of all mine products come from the 6 provinces Sonora, Zacatecas, Chihuahua, Coahuila, San Luis Potosi and Durango. The mining industry takes third place as a source of Mexico‘s foreign income, with the latest available figure being 23.4 billion US$ in 2010, behind automobile and automobile components (64,9 billion US$) and oil exports (41.7 billion US$) but ahead of the tourism industry (11.9 billion US$).

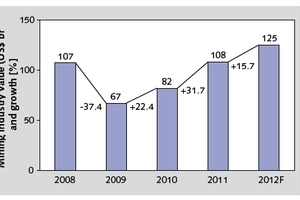

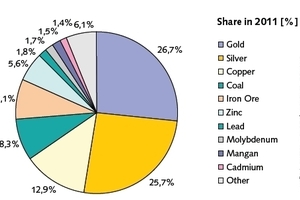

2012 is a record-breaking year for the Mexican mining industry. Fig. 2 shows the value of the mining industry and the annual rates of growth. It is clear that the industry has completely recovered from the crisis in 2009, when it crashed by -37 %, and has again achieved substantial annual growth rates, the latest being 16 %. At present, the mining industry accounts for 9.2 % of the GDP, after 7.6 % in 2009. In 2011 the mining industry achieved a revenue of 19.5 billion US$. Gold has overtaken silver with a revenue of 5.22 billion US$ compared to 5.03 billion US$ and a market share of 26.7 % compared to silver‘s 25.7 % (Fig. 3). The TOP 5 minerals, i.e. gold, silver, copper, coal and iron ore, account for 81.8 % of all revenue. The TOP 10 minerals provide 93.9 % of all revenue. In the following sections, the three most important industrial sectors are reviewed, focussing on developments and the companies mining silver, gold and copper.

2 Silver production

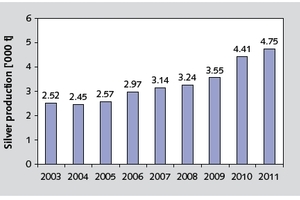

Fig. 4 shows the development of silver production in Mexico. Production has been steadily increasing since 2005. Even in 2009 a growth of 9.8 % was achieved. In 2010, output rose by 24.1 % to 4410 t before weakening in 2011 to a rate of 7.8 %, which still signified the achievement of a new peak of 4750 t. This put Mexico back in place 1 in the rankings with a share of 20.0 % in the worldwide production of 23,690 t (761.6 million Oz), before second-placed Peru. From 2010 to 2011 global production rose by 1.4 % and Mexico thus increased its worldwide market share of 19.3 % by 0.7 %. The silver production figure was particularly influenced by higher extraction rates as a byproduct of gold, lead and zinc mining. However, production of silver as a primary product actually decreased, one of the contributing factors being the reduced output of the biggest mine, Fresnillo.

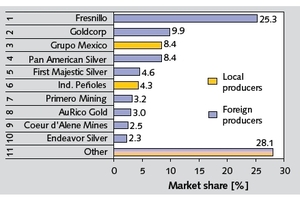

For 2010, the most important silver mines in Mexico are shown in Table 1. Fresnillo silver mine, owned by the identically-named Fresnillo plc, is by far the biggest with a production volume of 35.9 million ounces (MOz). Peñasquito, a new mine opened in 2010 by Goldcorp is in 2nd place with 14.0 MOz. 3rd place is occupied by Alamo Dorado, owned by Pan American Silver, with an output of 6.7 MOz. Up to 2011 there had been numerous changes in the ranking order. One example is the Palmarejo mine of Coeur d’Alene Mines, which achieved a production of 9.0 MOz, improving its position by one place in the ranking. At the Peñasquito mine the output rose from 14.0 to 19.0 MOz. Fig. 5 shows the market shares of the TOP 10 silver producing companies in Mexico. The market is relatively strongly fragmented. The TOP 10 companies account for a market share of 71.9 %, and the remainder is divided among more than 30 other mining companies.

In the TOP 10 there are only 2 local and 8 foreign groups of companies, of which 6 are from Canada alone and one each from the USA and the UK (Fig. 5). The market leader with a market share of 25.7 % is Fresnillo. This company was established in 2008 from the restructuring of Peñoles and the spinning-off of the precious metal business unit. It owns 7 active mines in Mexico, of which Fresnillo, Saucito, and Ciénega produce significant amounts of silver. The Saucito mine (Fig. 6), which only started operations in 2009, already produced 5.9 MOz in 2011 and thus immediately joined the TOP 10 mines in Mexico. In 2012, its output had increased by a further 18.7 % by the 3rd quarter. Fresnillo is also the biggest silver producer worldwide. Apart from silver, the company also mines gold, lead and zinc.

Place 2 in the rankings is occupied by the Canadian Goldcorp, which owns the 3 mines Los Filos, El Sauzal and Peñasquito. Peñasquito (Fig. 7) is the biggest open pit mine in Mexico, producing gold, lead and zinc in addition to silver. The mine came on stream as recently as 2010 for the record investment sum of 1.7 billion US$. Over its planned lifetime of 22 years the mine should produce 0.5 MOz of gold, 28 MOz of silver, 450 million pounds of zinc and 200 million pounds of lead. At this mine, 130 000 t of ore are extracted and processed every day. In the neighbourhood of Peñasquito, Goldcorp is opening up the Camino Rojo and Noche Buena mines, which are due to come on stream in 2014 and 2015, respectively. Two companies share 3rd place in the rankings: the local firm Grupo Mexico (Minera Mexico) and Pan American Silver, another Canadian company.

The remaining TOP 10 places are taken by companies with market shares between 2 and 5 %. These are the local firm Industrias Peñoles, the Canadian companies First Majestic Silver, Primero Mining, AuRico Gold and Endeavor Silver, as well as Coeur d’Alene Silver of the USA. Most of these mining companies are so-called junior miners that have developed mines and only recently started producing. The same applies to many of the other more than 30 companies mining silver in Mexico. These companies include such names as Great Panther Silver and Fortuna Silver Mines. The flagship mine of Fortuna is the San Jose Mine (Fig. 8) and in the case of Great Panther it is Guanajuato (Fig. 9).

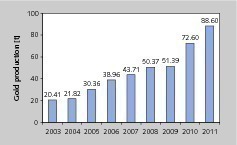

3 Gold production

At present, Mexico‘s mining industry makes the most money from gold production and this trend is increasing. In the last 5 years 26 new gold mines have been put into service. The last two years have seen substantial growth rates in gold production (Fig. 10). The production rate rose from 51.39 t in 2009 by 41.3 % to 72.60 t in 2010. In 2011 the growth of 22.0 % brought output to 88.6 t, which is more than four times the figure achieved 7 years ago. This development has been powered by enormous efforts and substantial investments by the mining industry. In 2011, Mexico was only in twelfth place in the global gold production rankings with a market share of approximately 3.3 %. The leaders are China (355 t, 13.1 % market share), Australia (270 t, 10 %), the USA (237 t, 8.8 %), Russia (200 t, 7.4 %) and South Africa (190 t, 7.0 %).

Table 2 provides an overview of the largest gold mines in 2010. The biggest mine is Goldcorp‘s Los Filos with an output of 306.1 kOz in 2010. Following quite a long way behind are Minera Frisco‘s El Coronel mine and Goldcorp‘s Peñasquito mine, which were already mentioned in an earlier section. With El Sauzal, Goldcorp even owns a third mine in the TOP 10. Fresnillo has two mines in the TOP 10: La Herradura and La Ciénega. Of the 10 mines, 7 are owned by Canadian mining companies, 2 by Fresnillo (UK), one by Coeur d’Alene (USA) and only one by a local mining company (Minera Frisco). In 2012, 5 new gold mines look set to commence operations. The largest project is that of Fresnillo and its Noche Buena mine with an annual capacity of 376 kOz. Yamana Gold is starting up the Mercedes mine with 125 kOz, Timmins Gold is planning the 100 kOz San Francisco Mine and US Gold will have the 50 kOz El Gallo mine. In addition to those, Cerro Resources‘ Cerro del Galo mine and Goldcorp‘s Camino Rojo mine are in the planning stage.

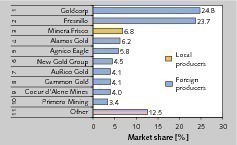

In the TOP 10 there is one local company (Minera Frisco), Fresnillo of the UK and Coeur d’Alene of the USA together with 7 Canadian companies (Fig. 11). The market leader with a gold output of 2530 kOz in 2010 was Goldcorp with a market share of 24.8 % from the 3 mines Los Filos, El Sauzal and Peñasquito (Fig. 12). Close behind in 2nd place comes Fresnillo with 23.7 % from its four mines La Herradura, Ciénega, Fresnillo and Solodad Dipolos. 3rd place in the rankings is taken by the local mining company Minera Frisco with a market share of 6.8 % from its El Coronel mine. The remaining companies are all from Canada and can be described as junior miners. Apart from the TOP 10, there are numerous other companies mining gold in Mexico, including the already mentioned Fortuna Silver Mines and Great Panther Silver, but also such companies as Goldgroup Mining, which is going to start up the 100 kOz Caballo Blanco mine (Fig. 13) in 2013.

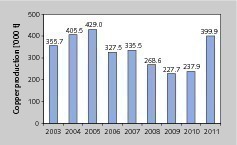

4 Copper production

In 2011, Mexico‘s copper production made a gigantic leap upwards (Fig. 14). The mining output rocketed by 68.1 % from 2010‘s 237.9 kt to reach 399.9 kt in 2011. Around 67 % of the copper production volume comes from the state of Sonora. In 2005, copper production had climbed to 425 kt, only to decrease to 228 kt by 2009. Due to rising price of copper and the fact that global demand grew to 16 035 kt in 2011 [1], it was possible to increase the rate of output. This particularly involved recommissioning the Cananea mine, which had been shut down for three years. On a worldwide scale Mexico occupies 12th place in the rankings with a market share of only 2.5 %. Globally, the leaders are Chile (5420 kt, 33.8 %), followed by Peru (1120 kt, 7.6 %), China (1190 kt, 7.4 %), the USA (1120 kt, 7.0 %) and Australia (940 kt, 5.9 %). The other TOP 10 countries are Zambia, Russia, Indonesia, Canada and the Congo (Kinshasa).

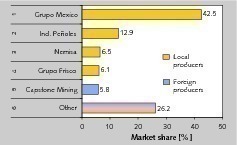

By far the biggest copper mine in Mexico is Grupo Mexico‘s La Caridad (Fig. 15) with its output rate of 118.0 kt (2010) (Table 3). But compared to the world‘s largest mine, Escondida in Chile with its annual capacity of 1.25 million t, Mexico‘s biggest mine is still very small. The Milpillas mine, owned by Industrias Peñoles, has an output rate of 21.8 kt, while Nemisa‘s Santa Ma. de La Paz delivers 18.0 kt. In contrast to the situation with silver and gold production, Mexico‘s copper mines are almost all owned by local companies. In fact, the only mine owned by a foreign company is Cozamin, which belongs to Capstone Mining. Capstone Mining is yet another Canadian firm. In 2012, three new copper mines are due to come on stream. These are Grupo Mexico‘s El Arco mine, the Canadian Baja Ming‘s El Boleo mine and the Chinese Jinchuan Group‘s Baherashi mine. The project costs of these mines are 1800 million, 1200 million and 884 million US$ respectively.

With its production volume of 118 kt, Grupo Mexico is the market leader with a market share of 42.5 % (data from 2010 (Fig. 16). Industrias Peñoles ranks second with an output of 35.9 kt and a market share of 12.9 %, followed by Nemisa with its output of 18.0 kt and 6.5 % market share. Places 4 and 5 in the rankings are held by Grupo Frisco with 16.8 kt and a market share of 6.1 % and Capstone Mining (Fig. 17) with 16.1 kt and a 5.8 % market share. In addition to the named companies, there are about 15 more copper mining companies which have a total output of 72.8 kt and a total market share of 26.2 %. Among these other companies are Frontera Copper, AgNico Eagle, Grupo Alfil, Minas de Bacis and Las Encinas. The Australian firm Azure Minerals is one of the mining companies developing new copper projects in Mexico.

5 Investments

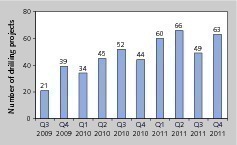

The renowned Metals Economics Group judges Mexico to be in 4th place in 2011 with a share of 6 % of the global exploration budget, behind Canada, Australia and the USA and before Chile, Peru, China, Russia and Brazil. New exploration drill holes are constantly being sunk in the search for minerals (Fig. 18) and the number of drilling projects has risen by approx. 300 % since 2009. According to information from Intierra Resource Intelligence, 1156 active mining projects were registered in Mexico in 2011. Fig. 19 provides an overview of the minerals for which exploration drilling was performed in 2011. 106 drilling projects were aimed at finding gold. Silver is in 2nd place with 96 projects, followed by lead-zinc with 41 and copper with 31. The projects in hand provide a good indication that Mexico‘s mining industry is set to continue its course of above-average growth rates in the years to come.

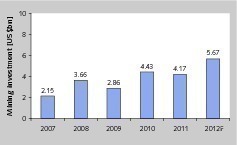

Fig. 20 shows the investments made in Mexico‘s mining industry in recent years. In the period from 2007 to 2012, a total of almost 23 billion US$ was invested. In 2012 a new record figure of 5.67 billion US$. will be reached. However, in order to implement all the existing projects, further investments totalling more than 10 billion US$ will be required (2012 included). Table 4 provides an overview of the estimated capital costs of the pending projects split up in accordance with the most important minerals (i.e. not including iron ore, coal and other minerals). The table also shows the planned annual revenues. By far the greatest proportion of the investments, as well as the planned revenue, is related to the mining of gold, silver and copper. Whether in the form of single minerals or polyminerals, these three minerals account for around 93.0 % of all investments and 96 % of all revenue.

6 Prospects

Mexico‘s mining industry is currently enjoying an unexpected boom. This is primarily due to the fact that the country is richly blessed with mineral resources and that the largest, hitherto unexploited reserves, were not discovered until comparatively recently. In addition, a mining-friendly investment policy has provided good incentives for foreign companies. Most activities are concerned with the three minerals gold, silver and copper. Gold reserves in the ores are in the order of 1400 t, which means that at the present mining output rate and with no further discoveries the deposits will have a lifetime of 16 years. In the case of silver, the current reserves total 37 000 t and thus have a calculated lifetime of 7.8 years. In the case of copper, the reserves of 38 million t should last 95 years at the present annual mining rate of 400 000 t.